Showing posts with label outlook. Show all posts

Showing posts with label outlook. Show all posts

Monday, December 5, 2011

Looking at nat gas again

Looks like it's heading south pretty hard. I'm not sure if this is just trying to run stops or will come down further. Ideally, I'd like to sell 3.25 puts for $1000+.

Wednesday, October 6, 2010

Market

It has been a while since my last post here. I've been just super-busy building a house. It's not done yet and I don't know if this will ever be done. There are so many times when I thought I should have just kept renting.

As the house is getting close to be done, I reactivated my trading account and slowly started getting used markets again. What I found very interesting lately is the relation between bonds and stocks. There's an old market wisdom saying, 'Bonds always know something...'

Stocks are rallying but if you look at Bonds, it's almost at all time high. If everyone's taking risk, Bonds shouldn't be at this level. Sure, Bonds can be wrong, but we've seen so many times markets would rally in a very thin volume or with no apparent reason. It goes up so slowly, but when it starts selling, it drops very very quickly.

Nat gas is at an attractive level regardless of fundamentals. I missed good trading opportunities in grains.

As the house is getting close to be done, I reactivated my trading account and slowly started getting used markets again. What I found very interesting lately is the relation between bonds and stocks. There's an old market wisdom saying, 'Bonds always know something...'

Stocks are rallying but if you look at Bonds, it's almost at all time high. If everyone's taking risk, Bonds shouldn't be at this level. Sure, Bonds can be wrong, but we've seen so many times markets would rally in a very thin volume or with no apparent reason. It goes up so slowly, but when it starts selling, it drops very very quickly.

Nat gas is at an attractive level regardless of fundamentals. I missed good trading opportunities in grains.

Monday, November 16, 2009

Will it hold?

ES is at 52 week high above 1100. The chart pattern looks higher, but we certainly don't want to go back below 1100 today, and then it'll change the whole sentiment.

Monday, November 9, 2009

Bond / note

I don't understand why bonds and notes are not declining. With indexes up this much, you'd think bonds and notes are down. I looked at the charts and looks like they are right on the neck line of head and shoulder. I still think there are mixed feeling of safe haven v.s. risks. As long as we keep this way, I think stocks keep rallying.

One of things I pay attention is money flow to mutual funds. To recent rallies, what people have been doing was to, in fact, take money out of mutual funds. People who bought at the market top in 2007 made up some of their losses. People who bought in 2008 are break-even, so they are cashing in.

As for gold, I have no idea. JC at TTM has been a gold bug for years. His 'buy gold' every night was pretty annoying, but now I wish I would have bought some and this is the difference between pros like him and idiots like me.

Despite broad commodity rallies, lumber is down quite a bit and nat gas is close to the multi year low (not the price wise, but after roll-overs, this is the contract low). I'm attempted to buy dec call options, but that'll probably add more headaches. I guess since I didn't buy markets go up from here. Who knows if i can ever exit these positions.

Friday, November 6, 2009

Job#

It seems non-farm # ruined all the party. We're still at the point where we keep losing. What we've had since early this year was simply a decrease of the degree of losing jobs. So unless jobs were added, the unemployment rate will not get better.

Nat gas resumed its trend to downside. It'll probably challenge the low again and probably dip lower. I'm glad I covered 1 before it tanked. I was just so close to cover all of them. All I needed was 1 day of staying at the high. Then my options would have been offset.

Lumber has moved to upside slightly. I think that's because of the extended home buyer's tax credit. I don't know how much it'll be helpful. Normally it'd take 6 months for experienced builders to build a house, so if they start building in 1 month (considering getting permits / getting bids etc), they only have 4 months until April. If they find a buyer before the end of April, good for them, but theses days new houses don't get sold before they are done.

Existing home sales are not much different. If you have a family, you probably don't move until your kids schools are done in mid to end of May, so what good is April deadline?

A little guy like me, unfortunately, have to just hope economy gets better. Everything started from housing market collapse. It then went to less consumer spending, company cost cut, job loss, foreclosure / short sales and it continues.

Thursday, October 8, 2009

Great depression #2

Whenever people talked about the similarity about Great Depression, I thought it was non-sense. The problem is different, the reaction is different and the solution is different. Furthermore, if people are so smart about it, why didn't people prevent it from happening in the first place?

Yesterday Aussie raised their key interest rate, which is the 1st among G20 countries. Everybody thinks US and other countries will follow. Was that a good decision? I do not think so. Shortly after the great depression, in fact markets did rally quite a bit, but then people started worrying about dollar and started tightening the money supply. In my opinion, that's actually the reason for the Great Depression not the initial reason.

We are facing the exact same problem right now. The initial problem was sub-prime / credit crisis / real estate bubble etc, but we're at the exact same place where we're asking ourselves 'too much money flowing'?

I'm a big fan of Ben Bernanke, the fed chairman. He's an expert on how we could have avoided the Great Depression. So far he's done a great job. It could have been better, but I'm sure everybody agrees we could have been a lot worse than now. I hated Alan Greenspan, the former fed chairman. I think he caused all the problems to bypass dot-com bubble.

If Bernanke is smart enough he shouldn't raise the rate so soon. We're at a record high deficit, but for example, 1 million dollar in savings now probably is 1/10 of the purchasing power in 30 years, so it may not be as bad as it sounds in terms of the deficit.

In addition, real-estate markets haven't been improved at all. People keep asking what they should do between short-sale and foreclosures, loan default, getting rid of 2nd home, credit card settlement etc. Sure stocks lead 6 month ahead of economy. If that's the case, why people still face the record high foreclosure? Why did Chase bank cut my credit card line from $30K to $1500 without any reason.

I understand why people buy gold. But what I keep my eyes on is bonds. With all the inflation worries, why bonds is around 120? I hope policy makers get clues from there.

Monday, June 8, 2009

Outlook

I haven't written about the markets for a long time. I'm not sure how much to talk about.

I stopped day-trading for now. It has been profitable, but with a full time job and trying to force something during lunch hour or day off(s) here and there are jut not working well. Besides, the more I trade, the more I think swing and position trades are where big money can be made.

Accordingly, I closed all of day trading accounts and simply moved all the money to an out-dated TradeStation Future's 4.0 platform. This platform is probably what you saw sometime in 2002 where you have to manually type the price. No bracket or DOM. Charting doesn't have zoom in/out not to mention with no real time update. But I keep this because I can trade pit-traded contracts. Besides, RJO (TS' clearing firm), knows futures options trading very very well.

I tried to change to Interactive Brokers and move all of my positions. RJO has been around for a long time, so they know what they are doing. What RJO told me was when futures transfer happens, options would go out first and the next business day cash will go out. When they receive, they receive futures positions first and receive cash next day. What IB told me was, they can't accept my position without cash transferred first. I do understand just in case of market collapse. But as they requested, I sent them my statement proving I have 10x more money sitting at RJO, which will be transferred. So screw it, and I'm going to just stay with Futures 4.0.

Ironically, this helps me not trade something I didn't plan. Day-trading with this platform is impossible. I may move to IB in the future, but probably not until I get out of NG or LB.

-NG-

Speaking of NG, I'm still holding 3 long futures, 1 put and 2 call options. Before, I didn't make up my mind between inflation and deflation, but now I'm convinced on the inflation side. I should really hold on to NG. Risk is big, but so is the reward. If this stays volatile, I can keep bringing more premiums from options. Downside is limited to 0 and upside is more likely. At this point, I'm not sure if I will get assigned on 3.5 July put, but I'm okay either way. If I do, 4.5 and 5 calls will be worthless keeping all the premium. I'll wait for a bounce to write Aug calls. I like to see above 5 and I ultimately like to have a runner with a break even stop.

-LB-

I've been holding Lumber for about a year and half. That's absolutely crazy. It's been moving up except today being almost limit-down. It went up too fast too much recently, so this kind of pull-back is necessary. As for targets, I'm not sure. I'm really attempted to get everything out at 230-240, but that shouldn't be the way I'm supposed to trade. 350 price level is likely even without inflation, but I don't know if I am that patient. I still have this bad habit of taking profits too soon, while take big stops. I must admit I'm still more patient on losers.

-Stocks-

I'm surprised to hear many miss the recent move up since March. I thought I was the only overly cautious person thinking we'll quickly turn and test the bottom with no time. What's more surprising is many people think we'll test the bottom soon. What are the markets doing? The exact opposite thing. If I didn't know anything about the markets, I just have to listen to so called gurus, but I'm still not an expert, but I'm not a newbie either, so I'm confused between.

I like to see stocks go up, but it'll probably just range-bound during the whole summer. If stocks sustain in the range, commodities will shoot to the upside. However, if stocks do get sold, commodities will be de-leveraged again just like before.

I finally bought some gold stock on my Roth IRA. This account is so small that, I care less about it. If gold goes, chances are dollars go down, but I'm hedged.

Wednesday, February 11, 2009

Markets

I'm not doing much. I keep an eye on markets, but there's simply no direction. Since stocks are not moving, all other commodities are not moving either. I'm still holding NG and LB. NG is hanging around break-even point. I'll roll over early and try to sell Apr puts. Lumber went as low as 139ish and had 3 limit up days. It then again went down, so now being traded around 155.

I'm not sure if markets are trying to bottom out here or test the low again. The best possible case is we have one extreme hammer day to run stops and close above the open.

Bull markets are usually very slow and small ,and bear market rallies are fast and big.

I'm not sure if markets are trying to bottom out here or test the low again. The best possible case is we have one extreme hammer day to run stops and close above the open.

Bull markets are usually very slow and small ,and bear market rallies are fast and big.

Tuesday, January 20, 2009

Outlook and update

-Indexes-

Everybody pretty much knows what to expect. 813 has been the key level in ES and today we finally closed below. I was hoping for an inverted head and shoulder, but closing below 813 unfortunately invalidated it. I hate giving tax money to those Wall St. greedy banks, but unfortunately they are the backbone of our economy. All the banks got killed today. I wouldn't be surprised if Citi or Bank of America go bankrupt. I expect markets will go through the low of 2008 to run stops. At that point, we might see actions on the both sides, but I think markets will really scare away people looking like it'll clearly break, but then it'll snap back. But what do I know about markets.

-Natural Gas-

As stocks sink, all the commodities get sold to meet margins. My put option is currently in the money with only 1 week to go. Since I brought about $2K, I'm about b/e or a bit down overall. Ideally, I want NG to close right below 5 before expiration, so I get assigned and I sell Mar calls right away. A bigger question is either I sell another put at 4.5 or 4. This NG trade can be the trade of the year for me, but I don't want to over-trade or get too greedy. In order to get more positions, I made additional deposits. Hopefully my broker deposits quickly.

-Lumber-

What can I say about this trade. Look at the chart above. Basically, I got involved with Lumber since Jan 2008. Carrying costs have been killing me. Usually I can offset carrying costs by utilizing options, but so far I did only once. You can tell Lumber's carrying cost by looking at the difference between March and May contract. I am honestly getting pretty upset and I really like to see how low it can go. I have enough capital, so I'll keep adding until it goes to zero. Even if I get out at break-even, I'll be up quite a bit on my portfolio at year end.

Thursday, December 4, 2008

Lumber

Lumber is approaching to 170 pretty quickly. I don't think any of people I know trade Lumber. I'm down quite a bit on this Lumber trade. Things just do not look good. I feel like I'm a newbie who is holding the losing trades forever. If I remember that feeling correctly, I felt better once I just sucked it up and took the loss. (Then watched the trade go my way, of course.)

Markets are going to do exactly what they want to do. They will keep doing it until most of people puke and give up everything. I'm trying real hard to remain calm, but it is very hard.

When I first got involved with Lumber, I thought it wouldn't go below 200 although it could. I guess I didn't fully accept the risk. Now I'm considering the ultimate risk level. What if Lumber goes to zero and what the risk is going to be. I still plan on selling puts every 40 pts or so. So 130, 90, 50, and 10. At that time, I'll be holding 8 lots. If Lumber is at 10, my open drawdown will be -$122,100 (excluding commissions including premiums written) with the avg of 148.75. Yikes, I can't even begin to imagine when Lumber becomes free!

The guy who taught me this method said once he was in Coffee trade for 2 years. (I'm holding my lumber for about a year). During that time, he advised this trade to others, but many just couldn't have enough patience. Even if one guy waited for 2 years, he got out at break-even.

Sure enough, Coffee went way beyond the avg price and the guy who taught me got out with $20K profit per contract. He's also in Lumber trade. His avg price is a lot higher than mine, but he seems calm.

At the same time, Natural Gas and Crude Oil are getting very interesting. I'd like to go long any time, but I'm not quite sure if we'll really go through worse than Great Depression. I personally don't think so (or don't want to believe because of Lumber. Yeah I'm biased!). I think Gov will do whatever they can. They don't care if we see Oil at $10000 or not, and they just want to get the heck out of this mess.

I'm just talking loud myself to see what I should do. Sometimes it helps talk out loud, right? What I should do is to stay calm and take advantage of what I'm seeing. Cotton, OJ, Crude, and Natural Gas all look great. I've been sitting on cash and I think I'll move all of them into my position trading account. This doesn't mean I'm going to buy 10 Nat Gas. I'll still approach conservatively, and trade as if they'll go to zero (a mistake learned from Lumber).

Markets are going to do exactly what they want to do. They will keep doing it until most of people puke and give up everything. I'm trying real hard to remain calm, but it is very hard.

When I first got involved with Lumber, I thought it wouldn't go below 200 although it could. I guess I didn't fully accept the risk. Now I'm considering the ultimate risk level. What if Lumber goes to zero and what the risk is going to be. I still plan on selling puts every 40 pts or so. So 130, 90, 50, and 10. At that time, I'll be holding 8 lots. If Lumber is at 10, my open drawdown will be -$122,100 (excluding commissions including premiums written) with the avg of 148.75. Yikes, I can't even begin to imagine when Lumber becomes free!

The guy who taught me this method said once he was in Coffee trade for 2 years. (I'm holding my lumber for about a year). During that time, he advised this trade to others, but many just couldn't have enough patience. Even if one guy waited for 2 years, he got out at break-even.

Sure enough, Coffee went way beyond the avg price and the guy who taught me got out with $20K profit per contract. He's also in Lumber trade. His avg price is a lot higher than mine, but he seems calm.

At the same time, Natural Gas and Crude Oil are getting very interesting. I'd like to go long any time, but I'm not quite sure if we'll really go through worse than Great Depression. I personally don't think so (or don't want to believe because of Lumber. Yeah I'm biased!). I think Gov will do whatever they can. They don't care if we see Oil at $10000 or not, and they just want to get the heck out of this mess.

I'm just talking loud myself to see what I should do. Sometimes it helps talk out loud, right? What I should do is to stay calm and take advantage of what I'm seeing. Cotton, OJ, Crude, and Natural Gas all look great. I've been sitting on cash and I think I'll move all of them into my position trading account. This doesn't mean I'm going to buy 10 Nat Gas. I'll still approach conservatively, and trade as if they'll go to zero (a mistake learned from Lumber).

Tuesday, November 11, 2008

Still watching

Markets are down today. We've been in the range for quite some time. I don't plan on doing anything until we break above 1000 or below 825 on ES. I'll take either buy or sell a pullback to that level.

I placed two orders (sell puts): Natural Gas and Cotton. They both need to be beaten down a bit more until my puts get filled. I can hold them until they both go to zero. (Will it be possible?)

I honestly don't know where markets are going to go, but everybody seems very skeptical about economy. Most of people think it'll get worse. Everybody I know thinks markets will go one way, yet they are still holding their longs. I guess that's why markets don't go anywhere.

As for day trading, I'm still working on my strategy. I and Jack have been working together for a while and we think we have one solid setup. Just one setup. The problem really boils down to psychology and time. I just can't watch markets during the day because of the full time job, but I can't just quit just in case.

What I'll do is to use vacation days and trade a few days here and there. I'll also record my real time trades to show you why I get in, why I take profits and how I trail stops. I'll post the result here and you guys (if there's any) can tell me what I'm doing right or wrong.

I placed two orders (sell puts): Natural Gas and Cotton. They both need to be beaten down a bit more until my puts get filled. I can hold them until they both go to zero. (Will it be possible?)

I honestly don't know where markets are going to go, but everybody seems very skeptical about economy. Most of people think it'll get worse. Everybody I know thinks markets will go one way, yet they are still holding their longs. I guess that's why markets don't go anywhere.

As for day trading, I'm still working on my strategy. I and Jack have been working together for a while and we think we have one solid setup. Just one setup. The problem really boils down to psychology and time. I just can't watch markets during the day because of the full time job, but I can't just quit just in case.

What I'll do is to use vacation days and trade a few days here and there. I'll also record my real time trades to show you why I get in, why I take profits and how I trail stops. I'll post the result here and you guys (if there's any) can tell me what I'm doing right or wrong.

Thursday, November 6, 2008

Scare people away?

Markets are really trying hard to scare people away now. People, who have been holding, got some relief from the election rally. Yesterday and toady, we have been going down pretty hard. If I were those people who are hoping for more rally are very confused now, thinking 'If this thing goes below the recent low, it'll probably go way below. I will sell and buy at lower price.'

The question is markets have to convince people enough that this will go further down. I don't think it has happened yet.

I'm thinking about selling Jan CL 30 Puts. I never thought about this situation when oil was close to 150, but no one just never know!

I exited the remaining AAPL at 101 (from 93 entry) this morning. I was using $10 trail stop and got hit. I'll monitor AAPL and GS closely to get positioned in my Roth IRA. Other than this, I'm still watching NG, but every time I place an order, it just moves away. The Lumber had some dead cat bounce in the last 3 days, which was good, but today started diving again. This was a minimum of 2 year trade, but man, maybe longer than that.

The question is markets have to convince people enough that this will go further down. I don't think it has happened yet.

I'm thinking about selling Jan CL 30 Puts. I never thought about this situation when oil was close to 150, but no one just never know!

I exited the remaining AAPL at 101 (from 93 entry) this morning. I was using $10 trail stop and got hit. I'll monitor AAPL and GS closely to get positioned in my Roth IRA. Other than this, I'm still watching NG, but every time I place an order, it just moves away. The Lumber had some dead cat bounce in the last 3 days, which was good, but today started diving again. This was a minimum of 2 year trade, but man, maybe longer than that.

Wednesday, October 29, 2008

AAPL

I bought AAPL at 93.5 a few days ago and today I sold half of my position at 107.5. I traded off of Roth IRA, so even if it's about 14 pts, I didn't have many shares. Going into FOMC announcement, I thought I should sell and buy back if we get a pull back. Granted, if we can consolidate at this level for a week, we might see some up move.

Yesterday's action was really good for bulls. Engulfing pattern is one of powerful reversal patterns I've seen. But remember the trend is still down.

Other commodities are all rallying today. If or when we get out of this mess, I can see people complain again about inflation. At that time, oil should go to 200 and beans go to $20/b easily.As with other futures, natural gas completely moved away. This time, I really want to be prepared for that situation.

As for NG trade, I just don't have much luck with it or I'm just too conservative as it came close to my entry but moved away significantly.

Yesterday's action was really good for bulls. Engulfing pattern is one of powerful reversal patterns I've seen. But remember the trend is still down.

Other commodities are all rallying today. If or when we get out of this mess, I can see people complain again about inflation. At that time, oil should go to 200 and beans go to $20/b easily.As with other futures, natural gas completely moved away. This time, I really want to be prepared for that situation.

As for NG trade, I just don't have much luck with it or I'm just too conservative as it came close to my entry but moved away significantly.

Monday, October 13, 2008

Short covering

What a day. Cash nasdaq +168, dow +813 and s&p +92 right now. We were over-due for a bounce, but jeez.

As we're still in a down-trend, I don't think the worst is over yet. I want markets to go up and up so that econ is going and I can get out of my lumber trade, but you don't see many 'V' bottoms. Bottoms are usually rounded and happen after a long range-consolidation whereas tops usually have inverted V shape.

Think of this way. We went straight down for a few days in a row without any pullback. It was absolute panic selling. Pros, who still have a lot of money, are thinking if you missed the boat to short, what's the logical place to short. Pros seem to wait for pullback (especially in indexes).

I don't know if we'll make a new low or not, but I think we'll have another downside to make either a new low, or a higher low. What traders should look for is the move between a well established resistance to the Friday's low. 1060 level in ES seems like a good level to go short, should we get there.

Keep in mind that it's an options expiration week (10/17). People probably loaded with puts and scared money is in the puts side. Markets will try to make them as worthless as possible. This might conincide with a rally to 1060 level, so let's see.

Friday, October 10, 2008

Everybody is selling everything

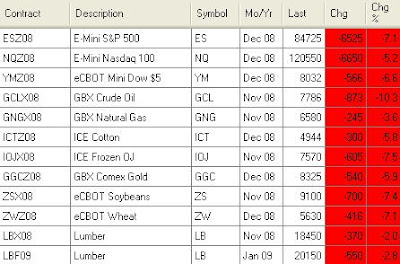

I don't know if you can see it, but basically every futures contract I'm watching is selling off not to mention Crude oil is -8.73 or -10% and lumber -3.7 or -2%. You know what indexes are doing of course.

In current market environment, everybody wants cash. People get margin calls and need to liquidate their positions. I even see margin on ES or lumber increased quite a bit, so I had to deposit some more.

I'm looking to sell Nat gas and have orders in. This will be another long term trade, but unlike Lumber, NG is very volatile and I should be able to be in and out of options all the time.

I looked at the performance of the money club I was in. At the beginning of Aug it had about 4 million and guess how much it has now. 2.4 million. I'm losing money on that, but gladly I took 93% of my money before I got hit.

Preserving your cash is not a bad idea. Today's close could be very important. I'm expecting we rally up and have a strong close to force some short covering. But what I do know. I'm still trying to learn how to trade.

Tuesday, October 7, 2008

Wacky idea

Here's an extreme (but unrealistic) idea.

In the last few days, nasdaq went down -75 pts every day (roughly), s&p went down -40 pts and -400 pts on dow. Today I thought what if indexes keep dropping. For example, S&P is currently traded around 1000. With this pace, it takes only 25 days for S&P to go to zero from 1000. Have you ever thought that indexs go zero???

I know it's not possible because stocks get kicked out of s&p if they are not doing well. Many people got involved with stocks lately because they are cheap. I'm trying to tell them over and over again that stocks can go zero, but no one listens and keep buying LEH, FNM, FRE etc...

In the last few days, nasdaq went down -75 pts every day (roughly), s&p went down -40 pts and -400 pts on dow. Today I thought what if indexes keep dropping. For example, S&P is currently traded around 1000. With this pace, it takes only 25 days for S&P to go to zero from 1000. Have you ever thought that indexs go zero???

I know it's not possible because stocks get kicked out of s&p if they are not doing well. Many people got involved with stocks lately because they are cheap. I'm trying to tell them over and over again that stocks can go zero, but no one listens and keep buying LEH, FNM, FRE etc...

Monday, October 6, 2008

Opportunities

Everybody is in fear. People at work who usually talk about sports or politics are talking about stock markets. I'm in the same fear as well. I was going to start building a house in 2 months, but I told my wife that we better wait until Jan 09 or so.

My supervisor who's about 45 years old said he's -30% YTD in his retirement account. I would safely say that's about -$100K. At work, I don't talk about markets much because people don't understand what I do (as a side job?) anyway. I didn't even tell all of my retirement money is on cash since Dec 07.

As global markets go down including indexes and other leverage instrument, there are a few markets that started looking very attractive. I talked about this before, but they quickly bounced off and ran away. Now it's back. Sure, the lumber trading still gives me a lot of headache (today limit down, ouch), but I need to be objective.

1. Cotton. Look at monthly chart to see where we're. I'm thinking about selling 50 puts and slowly accumulate.

2. Orange juice. This is at an interesting level, but I think it needs to come down more just to be conservative.

3. Natural gas. I'll be very aggressively positioned. The current price of NG is 6.8ish. I'll sell 6 puts for $1500 or better. Then every 0.5, I'll sell more put for another $1500+. I have a good chunk of money sitting at the bank (which I was going to use to build a house) and I just requested a transfer and I'll send a check to my broker this week. I know this doesn't happen often, so I want to make sure I'm involved with it.

The point is when the public is in panic, there's always something one can take advantage of.

Just be careful in this market and make sure you do not overtrade.

My supervisor who's about 45 years old said he's -30% YTD in his retirement account. I would safely say that's about -$100K. At work, I don't talk about markets much because people don't understand what I do (as a side job?) anyway. I didn't even tell all of my retirement money is on cash since Dec 07.

As global markets go down including indexes and other leverage instrument, there are a few markets that started looking very attractive. I talked about this before, but they quickly bounced off and ran away. Now it's back. Sure, the lumber trading still gives me a lot of headache (today limit down, ouch), but I need to be objective.

1. Cotton. Look at monthly chart to see where we're. I'm thinking about selling 50 puts and slowly accumulate.

2. Orange juice. This is at an interesting level, but I think it needs to come down more just to be conservative.

3. Natural gas. I'll be very aggressively positioned. The current price of NG is 6.8ish. I'll sell 6 puts for $1500 or better. Then every 0.5, I'll sell more put for another $1500+. I have a good chunk of money sitting at the bank (which I was going to use to build a house) and I just requested a transfer and I'll send a check to my broker this week. I know this doesn't happen often, so I want to make sure I'm involved with it.

The point is when the public is in panic, there's always something one can take advantage of.

Just be careful in this market and make sure you do not overtrade.

Monday, September 29, 2008

History

I like science and math, but I don't like history.

However, I truly believe that we're standing in the middle of history that hasn't happened for about 90-100 years.

Thanks for economy slow down. My lumber trading is going down to toilet. I might need 'p'lum(b)er. A bad joke?

Regardless of Lumber, I hate greedy wall st. companies, but unfortunately if they don't do well, our whole econ will struggle.

Other than holding the lumber, I'm trying to sell Nov Nat gas puts. By the way, the soybean spread trade, I indeed exit too early. That would have helped the lumber drawdowns. I'm still learning here, but tastes sour for sure.

However, I truly believe that we're standing in the middle of history that hasn't happened for about 90-100 years.

Thanks for economy slow down. My lumber trading is going down to toilet. I might need 'p'lum(b)er. A bad joke?

Regardless of Lumber, I hate greedy wall st. companies, but unfortunately if they don't do well, our whole econ will struggle.

Other than holding the lumber, I'm trying to sell Nov Nat gas puts. By the way, the soybean spread trade, I indeed exit too early. That would have helped the lumber drawdowns. I'm still learning here, but tastes sour for sure.

Tuesday, September 16, 2008

Why didn't feds lower the rate?

Yesterday, we saw a mega sell-off all over markets. The worst thing I've seen. The 9/11 move was more external problem, but yesterday we saw 150 year old hedge fund firm failed, a firm that survived through great depression was sold very cheap and the world's biggest insurance firm was desperately calling a distress signal. Thus, everybody was thinking the choice for the feds was clear! Oil is not at $150 any more, grains came 30% off of its top, so cut the rate!

What a surprise, the feds just announced to keep the rate steady. Remember early this year, when Bear Sterns failed, we saw emergency Sunday night cut, lots of billions of injection etc. Here's what I am thinking. Every 'normal' people I know we're in deep trouble. Yes, we still are and we will for a while, but I think the worst could be finally behind. (Remember, when everybody knows, markets will do the exact opposite? ) When the feds rescued bears and even rescued Fannie and Freddie, there clearly seemed to be more serious coming. And yesterday there it was. Normally, lowering rates mean more liquidity, so markets love them. But we're in a situation where lowering rates mean more trouble to come.

This morning, it looked like markets are going to die (ES at -25 pts-ish), but 45mins after the keeping the rate news, we're rallying +15 pts! I always think that someone somewhere knows about what's going on. Not necessary smart people but they somehow have information about what will happen and we're seeing exactly that.

In terms of technical perspective, ES has a long bottom-tail, which is one of powerful signs of exhaustion. When technical meets fundamental, we see a steady move to one side. In this case, to the upside.

Remember Goldman Sachs said oil will go to $200 by the end of summer? People got scared and putting lots of money onto oil funds or natural resources. Oil is currently around $90! GS said it's supply / demand. Emerging countries' demands are getting higher and higher. I said that was a complete BS. It was all speculations after all. You see all hedge funds are liquidating everything to get chase. I bet Lehman and Meryl sold a lot of grains and oils. (By the way, I still like GS after LEH and MER taken down badly. Goldman Empire from now on???)

Then again, thanks for bad housing markets. My lumbers are down a lot now. It consolidated for a while and took a few more dives in the last few days. I'm trying to sell 1 Nov 210P for $500 ish for cost averaging. Today the price came to 213, but my puts didn't get filled. If futures get so low, there's not much extrinsic value or no volume at all. Besides, Lumber is pit-traded contract, so god knows what pit traders do to screw people like me. I'll leave the order as it is for now.

I'm also trying to sell 70 CL puts. This extreme down move will end soon. If I get one more day of sell-off, I'll get filled, and when it bounces, I'll buy back. Now the problem is if I get one more day of selling or not.

As a 20/20 hindsight, I did exit the soybean-meal spread trade way early. The spread is now around $24K when I exited it was around $27K. An extra $6K (I was holding 2 spreads).... Ok, I'll go to corner and stay there for 10 mins as a punishment.

What a surprise, the feds just announced to keep the rate steady. Remember early this year, when Bear Sterns failed, we saw emergency Sunday night cut, lots of billions of injection etc. Here's what I am thinking. Every 'normal' people I know we're in deep trouble. Yes, we still are and we will for a while, but I think the worst could be finally behind. (Remember, when everybody knows, markets will do the exact opposite? ) When the feds rescued bears and even rescued Fannie and Freddie, there clearly seemed to be more serious coming. And yesterday there it was. Normally, lowering rates mean more liquidity, so markets love them. But we're in a situation where lowering rates mean more trouble to come.

This morning, it looked like markets are going to die (ES at -25 pts-ish), but 45mins after the keeping the rate news, we're rallying +15 pts! I always think that someone somewhere knows about what's going on. Not necessary smart people but they somehow have information about what will happen and we're seeing exactly that.

In terms of technical perspective, ES has a long bottom-tail, which is one of powerful signs of exhaustion. When technical meets fundamental, we see a steady move to one side. In this case, to the upside.

Remember Goldman Sachs said oil will go to $200 by the end of summer? People got scared and putting lots of money onto oil funds or natural resources. Oil is currently around $90! GS said it's supply / demand. Emerging countries' demands are getting higher and higher. I said that was a complete BS. It was all speculations after all. You see all hedge funds are liquidating everything to get chase. I bet Lehman and Meryl sold a lot of grains and oils. (By the way, I still like GS after LEH and MER taken down badly. Goldman Empire from now on???)

Then again, thanks for bad housing markets. My lumbers are down a lot now. It consolidated for a while and took a few more dives in the last few days. I'm trying to sell 1 Nov 210P for $500 ish for cost averaging. Today the price came to 213, but my puts didn't get filled. If futures get so low, there's not much extrinsic value or no volume at all. Besides, Lumber is pit-traded contract, so god knows what pit traders do to screw people like me. I'll leave the order as it is for now.

I'm also trying to sell 70 CL puts. This extreme down move will end soon. If I get one more day of sell-off, I'll get filled, and when it bounces, I'll buy back. Now the problem is if I get one more day of selling or not.

As a 20/20 hindsight, I did exit the soybean-meal spread trade way early. The spread is now around $24K when I exited it was around $27K. An extra $6K (I was holding 2 spreads).... Ok, I'll go to corner and stay there for 10 mins as a punishment.

Thursday, September 4, 2008

Sold all

I sold all of my Long (stocks) positions. Stocks (or indexes) were in a range for a long time and they broke down (ES' 1260) with a really big volume. I can tell a lot of big money flowing into the short side and this indeed seems to be a new leg down to test and break the 52-week low.

I have an order in Natural gas, but I don't think I'm gonna get filled unless it comes close to 6.7-ish. LB is doing nothing as usual. I might have to sell Nov puts since time decay is significant on Oct contract.

I have an order in Natural gas, but I don't think I'm gonna get filled unless it comes close to 6.7-ish. LB is doing nothing as usual. I might have to sell Nov puts since time decay is significant on Oct contract.

Subscribe to:

Posts (Atom)