Jan Natural Gas (NG) is close to 6, which makes the value of Jan 5.50 put worthless. Thus, I keep all the premium I wrote. The total profit of this trade is $3180 less commissions.

Since NG is rallying, I'm not able to do anything until NG drops somewhere around 5.5 again. If so, I'll sell 'Feb' NG put again.

Wednesday, December 24, 2008

Monday, December 22, 2008

Covered 1 Jan 170 put

Lumber rallied and my exit was filled at 0.9 (or $99 less commissions). My profit is 5.5 - 0.9 = 4.6 (or $506 less commissions). I'll sell 1 Mar 170 puts once I roll over my current position to the next expiration.

Friday, December 19, 2008

Natural Gas Update

NG Jan put I'm holding expires on Wed, 12/24/08. Currently, it's in the money, so I'll likely get assigned a long position from 5.5. I'll roll this over to Feb long on coming Fri or Mon. As soon as I roll it over, I'll try to sell Feb 6 Call for 310 creating a covered call. In order to do that, NG has to bounce close to 5.5 I think.

Futures puts are a bit different from stock options because they are skewed to long side as everybody knows NG won't be free, but can go high with unlimited.

The real question is if NG continues to drop, where do I want to scale-in. I'd like to sell a 4.5 Put, but I'm afraid I am not able to bring enough premium. 5.0 for $3000+ premium or 4.75 for $2000+ premium...

Remember the margin on NG is pretty high and things can move very quickly. I've seen where NG made $100K equivalent move.

Futures puts are a bit different from stock options because they are skewed to long side as everybody knows NG won't be free, but can go high with unlimited.

The real question is if NG continues to drop, where do I want to scale-in. I'd like to sell a 4.5 Put, but I'm afraid I am not able to bring enough premium. 5.0 for $3000+ premium or 4.75 for $2000+ premium...

Remember the margin on NG is pretty high and things can move very quickly. I've seen where NG made $100K equivalent move.

Monday, December 15, 2008

Day trading back-log

Last week, I had a business trip to California for a week. One nice thing about that was I was able to day-trade open and close totalling 4 horus / day. I took 8 trades and the results are as follows (all before commissions):

Mon, 12/9:

#1: -$300

#2: $50

Tue, 12/10:

#3: $50

#4: $187.5

#5: $187.5

Wed, 12/11:

#6: $175

Thu, 12/12:

#7: $175

Fri, 12/13:

#8: $187.5

------------

Total: +$682.5 (less 21 round contracts of commissions)

All were traded on 2 or 3 lots at a time with ES only. I don't know if this is sign of something. I still need to gather more live trading data for sure at least for one solid month.

Mon, 12/9:

#1: -$300

#2: $50

Tue, 12/10:

#3: $50

#4: $187.5

#5: $187.5

Wed, 12/11:

#6: $175

Thu, 12/12:

#7: $175

Fri, 12/13:

#8: $187.5

------------

Total: +$682.5 (less 21 round contracts of commissions)

All were traded on 2 or 3 lots at a time with ES only. I don't know if this is sign of something. I still need to gather more live trading data for sure at least for one solid month.

Tuesday, December 9, 2008

Friday, December 5, 2008

Sold 1 Jan Lumber 170 Put for 5.5 ($605)

This is another cost-avg for my lumber trade. This option expries the end of this month (Dec 2008) and if I do get assigned, I'll be holding 4 lots. Lumber is definitely a free fall, especially with housing markets. I'll continue to trade my plan. I'm prepared even if Lumber goes to zero (free lumber for everybody).

Thursday, December 4, 2008

Lumber

Lumber is approaching to 170 pretty quickly. I don't think any of people I know trade Lumber. I'm down quite a bit on this Lumber trade. Things just do not look good. I feel like I'm a newbie who is holding the losing trades forever. If I remember that feeling correctly, I felt better once I just sucked it up and took the loss. (Then watched the trade go my way, of course.)

Markets are going to do exactly what they want to do. They will keep doing it until most of people puke and give up everything. I'm trying real hard to remain calm, but it is very hard.

When I first got involved with Lumber, I thought it wouldn't go below 200 although it could. I guess I didn't fully accept the risk. Now I'm considering the ultimate risk level. What if Lumber goes to zero and what the risk is going to be. I still plan on selling puts every 40 pts or so. So 130, 90, 50, and 10. At that time, I'll be holding 8 lots. If Lumber is at 10, my open drawdown will be -$122,100 (excluding commissions including premiums written) with the avg of 148.75. Yikes, I can't even begin to imagine when Lumber becomes free!

The guy who taught me this method said once he was in Coffee trade for 2 years. (I'm holding my lumber for about a year). During that time, he advised this trade to others, but many just couldn't have enough patience. Even if one guy waited for 2 years, he got out at break-even.

Sure enough, Coffee went way beyond the avg price and the guy who taught me got out with $20K profit per contract. He's also in Lumber trade. His avg price is a lot higher than mine, but he seems calm.

At the same time, Natural Gas and Crude Oil are getting very interesting. I'd like to go long any time, but I'm not quite sure if we'll really go through worse than Great Depression. I personally don't think so (or don't want to believe because of Lumber. Yeah I'm biased!). I think Gov will do whatever they can. They don't care if we see Oil at $10000 or not, and they just want to get the heck out of this mess.

I'm just talking loud myself to see what I should do. Sometimes it helps talk out loud, right? What I should do is to stay calm and take advantage of what I'm seeing. Cotton, OJ, Crude, and Natural Gas all look great. I've been sitting on cash and I think I'll move all of them into my position trading account. This doesn't mean I'm going to buy 10 Nat Gas. I'll still approach conservatively, and trade as if they'll go to zero (a mistake learned from Lumber).

Markets are going to do exactly what they want to do. They will keep doing it until most of people puke and give up everything. I'm trying real hard to remain calm, but it is very hard.

When I first got involved with Lumber, I thought it wouldn't go below 200 although it could. I guess I didn't fully accept the risk. Now I'm considering the ultimate risk level. What if Lumber goes to zero and what the risk is going to be. I still plan on selling puts every 40 pts or so. So 130, 90, 50, and 10. At that time, I'll be holding 8 lots. If Lumber is at 10, my open drawdown will be -$122,100 (excluding commissions including premiums written) with the avg of 148.75. Yikes, I can't even begin to imagine when Lumber becomes free!

The guy who taught me this method said once he was in Coffee trade for 2 years. (I'm holding my lumber for about a year). During that time, he advised this trade to others, but many just couldn't have enough patience. Even if one guy waited for 2 years, he got out at break-even.

Sure enough, Coffee went way beyond the avg price and the guy who taught me got out with $20K profit per contract. He's also in Lumber trade. His avg price is a lot higher than mine, but he seems calm.

At the same time, Natural Gas and Crude Oil are getting very interesting. I'd like to go long any time, but I'm not quite sure if we'll really go through worse than Great Depression. I personally don't think so (or don't want to believe because of Lumber. Yeah I'm biased!). I think Gov will do whatever they can. They don't care if we see Oil at $10000 or not, and they just want to get the heck out of this mess.

I'm just talking loud myself to see what I should do. Sometimes it helps talk out loud, right? What I should do is to stay calm and take advantage of what I'm seeing. Cotton, OJ, Crude, and Natural Gas all look great. I've been sitting on cash and I think I'll move all of them into my position trading account. This doesn't mean I'm going to buy 10 Nat Gas. I'll still approach conservatively, and trade as if they'll go to zero (a mistake learned from Lumber).

Wednesday, November 26, 2008

Covered 1 Jan 40 CT at 0.48

Cotton is rallying today and my exit order was filled at 0.48. I sold it for 2.15 ($1075) and exited at 0.48, which gave me 1.7 or +$835 (before commissions). The good thing about wiring options is when markets start moving, time value evaporate quickly which boosts my profit.

Only 24 days till expiration, my max profit was $240, whereas risk was unlimted, so even if I'm willing to get assigned, I decided to exit. I'll sell a put if markets drop again.

Only 24 days till expiration, my max profit was $240, whereas risk was unlimted, so even if I'm willing to get assigned, I decided to exit. I'll sell a put if markets drop again.

Wednesday, November 12, 2008

Sold 1 Jan Cotton put for 2.15 ($1075)

I sold 1 Jan Cotton Put for 2.15 (or $1075 less commissions). The strategy I'll be using is exactly the same as my lumber trade. Either I'll get assigned or keep all the premium I wrote.

I traded Cotton in 2006 and at that time I bought futures contract outright around 55. This time, since I'm holding Lumber, I got a bit more conservative and waited patiently. My plan is to sell another put at 30 and 2 more at 20. If Cotton somehow keeps dropping and gets to 20, I'll be holding 4 lots with the avg of 27.5. At that time, the drawdown will be $25000 (yikes). The lowest Cotton price I've seen is around $50 and I think $40 is a really solid level evn if I do get assigned.

The Jan Cotton options expire on Dec 19, so I'll keep you posted or you can click here.

I traded Cotton in 2006 and at that time I bought futures contract outright around 55. This time, since I'm holding Lumber, I got a bit more conservative and waited patiently. My plan is to sell another put at 30 and 2 more at 20. If Cotton somehow keeps dropping and gets to 20, I'll be holding 4 lots with the avg of 27.5. At that time, the drawdown will be $25000 (yikes). The lowest Cotton price I've seen is around $50 and I think $40 is a really solid level evn if I do get assigned.

The Jan Cotton options expire on Dec 19, so I'll keep you posted or you can click here.

Tuesday, November 11, 2008

Still watching

Markets are down today. We've been in the range for quite some time. I don't plan on doing anything until we break above 1000 or below 825 on ES. I'll take either buy or sell a pullback to that level.

I placed two orders (sell puts): Natural Gas and Cotton. They both need to be beaten down a bit more until my puts get filled. I can hold them until they both go to zero. (Will it be possible?)

I honestly don't know where markets are going to go, but everybody seems very skeptical about economy. Most of people think it'll get worse. Everybody I know thinks markets will go one way, yet they are still holding their longs. I guess that's why markets don't go anywhere.

As for day trading, I'm still working on my strategy. I and Jack have been working together for a while and we think we have one solid setup. Just one setup. The problem really boils down to psychology and time. I just can't watch markets during the day because of the full time job, but I can't just quit just in case.

What I'll do is to use vacation days and trade a few days here and there. I'll also record my real time trades to show you why I get in, why I take profits and how I trail stops. I'll post the result here and you guys (if there's any) can tell me what I'm doing right or wrong.

I placed two orders (sell puts): Natural Gas and Cotton. They both need to be beaten down a bit more until my puts get filled. I can hold them until they both go to zero. (Will it be possible?)

I honestly don't know where markets are going to go, but everybody seems very skeptical about economy. Most of people think it'll get worse. Everybody I know thinks markets will go one way, yet they are still holding their longs. I guess that's why markets don't go anywhere.

As for day trading, I'm still working on my strategy. I and Jack have been working together for a while and we think we have one solid setup. Just one setup. The problem really boils down to psychology and time. I just can't watch markets during the day because of the full time job, but I can't just quit just in case.

What I'll do is to use vacation days and trade a few days here and there. I'll also record my real time trades to show you why I get in, why I take profits and how I trail stops. I'll post the result here and you guys (if there's any) can tell me what I'm doing right or wrong.

Thursday, November 6, 2008

Scare people away?

Markets are really trying hard to scare people away now. People, who have been holding, got some relief from the election rally. Yesterday and toady, we have been going down pretty hard. If I were those people who are hoping for more rally are very confused now, thinking 'If this thing goes below the recent low, it'll probably go way below. I will sell and buy at lower price.'

The question is markets have to convince people enough that this will go further down. I don't think it has happened yet.

I'm thinking about selling Jan CL 30 Puts. I never thought about this situation when oil was close to 150, but no one just never know!

I exited the remaining AAPL at 101 (from 93 entry) this morning. I was using $10 trail stop and got hit. I'll monitor AAPL and GS closely to get positioned in my Roth IRA. Other than this, I'm still watching NG, but every time I place an order, it just moves away. The Lumber had some dead cat bounce in the last 3 days, which was good, but today started diving again. This was a minimum of 2 year trade, but man, maybe longer than that.

The question is markets have to convince people enough that this will go further down. I don't think it has happened yet.

I'm thinking about selling Jan CL 30 Puts. I never thought about this situation when oil was close to 150, but no one just never know!

I exited the remaining AAPL at 101 (from 93 entry) this morning. I was using $10 trail stop and got hit. I'll monitor AAPL and GS closely to get positioned in my Roth IRA. Other than this, I'm still watching NG, but every time I place an order, it just moves away. The Lumber had some dead cat bounce in the last 3 days, which was good, but today started diving again. This was a minimum of 2 year trade, but man, maybe longer than that.

Tuesday, November 4, 2008

Lumber roll over

I rolled over my lumber positions:

11/4/08

Sold 3 Nov Lumber at 193.10

Bought 3 Jan Lumber at 204.70

Note that I sold puts and got assigned, so I'm holding 3 lots total. My next level to add (in Jan contract) is if lumber gets to 170s.

11/4/08

Sold 3 Nov Lumber at 193.10

Bought 3 Jan Lumber at 204.70

Note that I sold puts and got assigned, so I'm holding 3 lots total. My next level to add (in Jan contract) is if lumber gets to 170s.

Oct P/L

I updated my Oct P/L. Not a good month, but I think it could have been worse. I mainly have only one position, Lumber. While everybody was liquidating everything, Lumber was no exception. One big mistake I made was I didn't quite understand about inflation and deflation in terms of diversification. Lumber benefits from economy inflation and Soybean-meal spread (remember?) trade benefits from deflation. In other words, while losing money on Lumber , the bean spread would have offset it. I got positioned the bean spread while we were going through inflation, which was good, but I exited too early. Markets got deflated, and I didn't have any position to hedge Lumber deflation.

I'm overall about break-even year-to-date where most of my money is. I'm not sure if I should be happy about that result, but I guess I'm still surviving.

I'm overall about break-even year-to-date where most of my money is. I'm not sure if I should be happy about that result, but I guess I'm still surviving.

Wednesday, October 29, 2008

AAPL

I bought AAPL at 93.5 a few days ago and today I sold half of my position at 107.5. I traded off of Roth IRA, so even if it's about 14 pts, I didn't have many shares. Going into FOMC announcement, I thought I should sell and buy back if we get a pull back. Granted, if we can consolidate at this level for a week, we might see some up move.

Yesterday's action was really good for bulls. Engulfing pattern is one of powerful reversal patterns I've seen. But remember the trend is still down.

Other commodities are all rallying today. If or when we get out of this mess, I can see people complain again about inflation. At that time, oil should go to 200 and beans go to $20/b easily.As with other futures, natural gas completely moved away. This time, I really want to be prepared for that situation.

As for NG trade, I just don't have much luck with it or I'm just too conservative as it came close to my entry but moved away significantly.

Yesterday's action was really good for bulls. Engulfing pattern is one of powerful reversal patterns I've seen. But remember the trend is still down.

Other commodities are all rallying today. If or when we get out of this mess, I can see people complain again about inflation. At that time, oil should go to 200 and beans go to $20/b easily.As with other futures, natural gas completely moved away. This time, I really want to be prepared for that situation.

As for NG trade, I just don't have much luck with it or I'm just too conservative as it came close to my entry but moved away significantly.

Tuesday, October 21, 2008

Losing patience

I'm really losing my patience here. I still do think we're going to go down futher to 'really' scare people away.

I bought '25' shares of AAPL on my Roth IRA (4K account!). AAPL's earning is today. I do like the company and I mean I really like the 'value' of the company.I own a few apple products and they are great. I'll like to hold these for a while regardless of the earning's result. Besides, I just ordered a new aluminum macbook and I'm very excited. My wife will take over my old white macbook. :) (thanks, hon.)

Lumber is where I really lose my patience at. Another limit down today. Markets go through inflation and deflation, but what's funny about lumber is, it has been deflated for about 2 years and still deflating. I'm wondering if it can actually go to zero. Will lumber be free? At least, since I'll build a house in 4 months, hopefully I can benefit the low lumber price.

Did I tell you have a Realtor license? I just got it to know about home buying and selling. Guess what, it seems I'll be a licensed general contractor as well. Maybe I'm too cheap, but I don't think they should be paid for work they 'usually' do at least in my area. The realtor exam was not hard and it doesn't seem on the general contractor either (1 book, 4 hr long open book test).

Typically, if you become your own general contractor, you can save 'at least' 20% of builders' quote. If you build your own house, you don't have to be licensed, but the community I'm looking at requires to hire a licensed one. Besides, lenders don't really like doing construction loan unless I deal with a licensed one. Above all, I really like to know what's involved and I want to build it right!

I don't usually talk about other stuff than markets, but I just suddenly thought about it. Sorry, if you're not interested.

OK, looks like AAPL's earnings came out. I bought mine at 93.50 and it had a little pop, but came back to my entry although it was down quite a bit before the announcement.

I bought '25' shares of AAPL on my Roth IRA (4K account!). AAPL's earning is today. I do like the company and I mean I really like the 'value' of the company.I own a few apple products and they are great. I'll like to hold these for a while regardless of the earning's result. Besides, I just ordered a new aluminum macbook and I'm very excited. My wife will take over my old white macbook. :) (thanks, hon.)

Lumber is where I really lose my patience at. Another limit down today. Markets go through inflation and deflation, but what's funny about lumber is, it has been deflated for about 2 years and still deflating. I'm wondering if it can actually go to zero. Will lumber be free? At least, since I'll build a house in 4 months, hopefully I can benefit the low lumber price.

Did I tell you have a Realtor license? I just got it to know about home buying and selling. Guess what, it seems I'll be a licensed general contractor as well. Maybe I'm too cheap, but I don't think they should be paid for work they 'usually' do at least in my area. The realtor exam was not hard and it doesn't seem on the general contractor either (1 book, 4 hr long open book test).

Typically, if you become your own general contractor, you can save 'at least' 20% of builders' quote. If you build your own house, you don't have to be licensed, but the community I'm looking at requires to hire a licensed one. Besides, lenders don't really like doing construction loan unless I deal with a licensed one. Above all, I really like to know what's involved and I want to build it right!

I don't usually talk about other stuff than markets, but I just suddenly thought about it. Sorry, if you're not interested.

OK, looks like AAPL's earnings came out. I bought mine at 93.50 and it had a little pop, but came back to my entry although it was down quite a bit before the announcement.

Monday, October 13, 2008

Short covering

What a day. Cash nasdaq +168, dow +813 and s&p +92 right now. We were over-due for a bounce, but jeez.

As we're still in a down-trend, I don't think the worst is over yet. I want markets to go up and up so that econ is going and I can get out of my lumber trade, but you don't see many 'V' bottoms. Bottoms are usually rounded and happen after a long range-consolidation whereas tops usually have inverted V shape.

Think of this way. We went straight down for a few days in a row without any pullback. It was absolute panic selling. Pros, who still have a lot of money, are thinking if you missed the boat to short, what's the logical place to short. Pros seem to wait for pullback (especially in indexes).

I don't know if we'll make a new low or not, but I think we'll have another downside to make either a new low, or a higher low. What traders should look for is the move between a well established resistance to the Friday's low. 1060 level in ES seems like a good level to go short, should we get there.

Keep in mind that it's an options expiration week (10/17). People probably loaded with puts and scared money is in the puts side. Markets will try to make them as worthless as possible. This might conincide with a rally to 1060 level, so let's see.

Friday, October 10, 2008

Everybody is selling everything

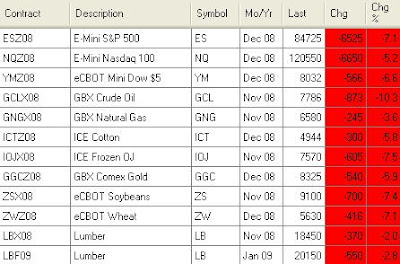

I don't know if you can see it, but basically every futures contract I'm watching is selling off not to mention Crude oil is -8.73 or -10% and lumber -3.7 or -2%. You know what indexes are doing of course.

In current market environment, everybody wants cash. People get margin calls and need to liquidate their positions. I even see margin on ES or lumber increased quite a bit, so I had to deposit some more.

I'm looking to sell Nat gas and have orders in. This will be another long term trade, but unlike Lumber, NG is very volatile and I should be able to be in and out of options all the time.

I looked at the performance of the money club I was in. At the beginning of Aug it had about 4 million and guess how much it has now. 2.4 million. I'm losing money on that, but gladly I took 93% of my money before I got hit.

Preserving your cash is not a bad idea. Today's close could be very important. I'm expecting we rally up and have a strong close to force some short covering. But what I do know. I'm still trying to learn how to trade.

Tuesday, October 7, 2008

Wacky idea

Here's an extreme (but unrealistic) idea.

In the last few days, nasdaq went down -75 pts every day (roughly), s&p went down -40 pts and -400 pts on dow. Today I thought what if indexes keep dropping. For example, S&P is currently traded around 1000. With this pace, it takes only 25 days for S&P to go to zero from 1000. Have you ever thought that indexs go zero???

I know it's not possible because stocks get kicked out of s&p if they are not doing well. Many people got involved with stocks lately because they are cheap. I'm trying to tell them over and over again that stocks can go zero, but no one listens and keep buying LEH, FNM, FRE etc...

In the last few days, nasdaq went down -75 pts every day (roughly), s&p went down -40 pts and -400 pts on dow. Today I thought what if indexes keep dropping. For example, S&P is currently traded around 1000. With this pace, it takes only 25 days for S&P to go to zero from 1000. Have you ever thought that indexs go zero???

I know it's not possible because stocks get kicked out of s&p if they are not doing well. Many people got involved with stocks lately because they are cheap. I'm trying to tell them over and over again that stocks can go zero, but no one listens and keep buying LEH, FNM, FRE etc...

Monday, October 6, 2008

Opportunities

Everybody is in fear. People at work who usually talk about sports or politics are talking about stock markets. I'm in the same fear as well. I was going to start building a house in 2 months, but I told my wife that we better wait until Jan 09 or so.

My supervisor who's about 45 years old said he's -30% YTD in his retirement account. I would safely say that's about -$100K. At work, I don't talk about markets much because people don't understand what I do (as a side job?) anyway. I didn't even tell all of my retirement money is on cash since Dec 07.

As global markets go down including indexes and other leverage instrument, there are a few markets that started looking very attractive. I talked about this before, but they quickly bounced off and ran away. Now it's back. Sure, the lumber trading still gives me a lot of headache (today limit down, ouch), but I need to be objective.

1. Cotton. Look at monthly chart to see where we're. I'm thinking about selling 50 puts and slowly accumulate.

2. Orange juice. This is at an interesting level, but I think it needs to come down more just to be conservative.

3. Natural gas. I'll be very aggressively positioned. The current price of NG is 6.8ish. I'll sell 6 puts for $1500 or better. Then every 0.5, I'll sell more put for another $1500+. I have a good chunk of money sitting at the bank (which I was going to use to build a house) and I just requested a transfer and I'll send a check to my broker this week. I know this doesn't happen often, so I want to make sure I'm involved with it.

The point is when the public is in panic, there's always something one can take advantage of.

Just be careful in this market and make sure you do not overtrade.

My supervisor who's about 45 years old said he's -30% YTD in his retirement account. I would safely say that's about -$100K. At work, I don't talk about markets much because people don't understand what I do (as a side job?) anyway. I didn't even tell all of my retirement money is on cash since Dec 07.

As global markets go down including indexes and other leverage instrument, there are a few markets that started looking very attractive. I talked about this before, but they quickly bounced off and ran away. Now it's back. Sure, the lumber trading still gives me a lot of headache (today limit down, ouch), but I need to be objective.

1. Cotton. Look at monthly chart to see where we're. I'm thinking about selling 50 puts and slowly accumulate.

2. Orange juice. This is at an interesting level, but I think it needs to come down more just to be conservative.

3. Natural gas. I'll be very aggressively positioned. The current price of NG is 6.8ish. I'll sell 6 puts for $1500 or better. Then every 0.5, I'll sell more put for another $1500+. I have a good chunk of money sitting at the bank (which I was going to use to build a house) and I just requested a transfer and I'll send a check to my broker this week. I know this doesn't happen often, so I want to make sure I'm involved with it.

The point is when the public is in panic, there's always something one can take advantage of.

Just be careful in this market and make sure you do not overtrade.

Saturday, October 4, 2008

Bloody September

I thought I was well diversified and I thought I was safe from the whole credit problem. My retirement has been staying out of stocks since Dec with +11% profit. I took 95% of my money out of my club (options) with +12% profit. They all are going through huge drawdowns and I protected my money well.

The big problem came from the Lumber. It's like a free fall and I'm getting killed. Lumber is well below the cost of production, but still falling. What's funny is I went to local lumber store to get some recommendation about framing companies. The store's manager said lumber price has stayed the same for the whole year? I was thinking, Whah? The futures went from 300 to 200 or -33%, but the lumber material is the same? Furthermore, he said the price of shingles are up because of the oil. Oil was at 150, but now below 100 and that should be -33% or so, but it stayed the same? Who takes all the money then?

Last month, I had about $8-9K profit, and I lost all in Sept. I'm still +$4K for the year, but was up almost $20K at one point. Of course, there are tons of mutual funds that were shut down or going through -25% YTD, so I'm guessing I'm okay, but it sure tastes sour.

Monday, September 29, 2008

History

I like science and math, but I don't like history.

However, I truly believe that we're standing in the middle of history that hasn't happened for about 90-100 years.

Thanks for economy slow down. My lumber trading is going down to toilet. I might need 'p'lum(b)er. A bad joke?

Regardless of Lumber, I hate greedy wall st. companies, but unfortunately if they don't do well, our whole econ will struggle.

Other than holding the lumber, I'm trying to sell Nov Nat gas puts. By the way, the soybean spread trade, I indeed exit too early. That would have helped the lumber drawdowns. I'm still learning here, but tastes sour for sure.

However, I truly believe that we're standing in the middle of history that hasn't happened for about 90-100 years.

Thanks for economy slow down. My lumber trading is going down to toilet. I might need 'p'lum(b)er. A bad joke?

Regardless of Lumber, I hate greedy wall st. companies, but unfortunately if they don't do well, our whole econ will struggle.

Other than holding the lumber, I'm trying to sell Nov Nat gas puts. By the way, the soybean spread trade, I indeed exit too early. That would have helped the lumber drawdowns. I'm still learning here, but tastes sour for sure.

Saturday, September 27, 2008

9/26 -$400

Dagger. Friday afternoon. One hour till market close. I thought the setup was great but it just didn't work out. Because of the volatility I used 2 pt stop (normally 1.5 pt ES stop) and I took a full stop out on 4 lots. I looked the trade over and over again and I don't think there's anything wrong. Throughout my 4 months of simulation I have 83% of chance to hit target 1, but I still have 17% of chance I get full-stopped out and this was one of them I guess.

I'll take the same trade anytime any day. Besides, I need to be more aggressive on setups just like I did on sim.

I'll take the same trade anytime any day. Besides, I need to be more aggressive on setups just like I did on sim.

Thursday, September 25, 2008

9/24 +$600

After missing lots of good trades (came close or ticked at me), I finally was able to make two trades. The first trade was +475 (before commissions) and the second trade was +125. The second trade was very unfortunate because it ticked at target 3, but turned around and stopped me out (only 15 contracts were traded on ES). Furthermore, it went then thru target 3. The difference was +125 v.s. +325. Oh well, that's the trading. I have two more days of 'bootcamp' trading with my friend, Jack, in OH.

Thursday, September 18, 2008

Sold 1 Nov 210 Put Lumber at 5.70 ($627)

Lumber kept on dropping, so I threw an order and got filled finally. This is for cost-averaging position. The expiration is 10/30 (or 10/31), so I'll hold until then. If I get assigned, great, my avg Lumber got lower. If I don't get assigned, I collected $627.

Tuesday, September 16, 2008

Why didn't feds lower the rate?

Yesterday, we saw a mega sell-off all over markets. The worst thing I've seen. The 9/11 move was more external problem, but yesterday we saw 150 year old hedge fund firm failed, a firm that survived through great depression was sold very cheap and the world's biggest insurance firm was desperately calling a distress signal. Thus, everybody was thinking the choice for the feds was clear! Oil is not at $150 any more, grains came 30% off of its top, so cut the rate!

What a surprise, the feds just announced to keep the rate steady. Remember early this year, when Bear Sterns failed, we saw emergency Sunday night cut, lots of billions of injection etc. Here's what I am thinking. Every 'normal' people I know we're in deep trouble. Yes, we still are and we will for a while, but I think the worst could be finally behind. (Remember, when everybody knows, markets will do the exact opposite? ) When the feds rescued bears and even rescued Fannie and Freddie, there clearly seemed to be more serious coming. And yesterday there it was. Normally, lowering rates mean more liquidity, so markets love them. But we're in a situation where lowering rates mean more trouble to come.

This morning, it looked like markets are going to die (ES at -25 pts-ish), but 45mins after the keeping the rate news, we're rallying +15 pts! I always think that someone somewhere knows about what's going on. Not necessary smart people but they somehow have information about what will happen and we're seeing exactly that.

In terms of technical perspective, ES has a long bottom-tail, which is one of powerful signs of exhaustion. When technical meets fundamental, we see a steady move to one side. In this case, to the upside.

Remember Goldman Sachs said oil will go to $200 by the end of summer? People got scared and putting lots of money onto oil funds or natural resources. Oil is currently around $90! GS said it's supply / demand. Emerging countries' demands are getting higher and higher. I said that was a complete BS. It was all speculations after all. You see all hedge funds are liquidating everything to get chase. I bet Lehman and Meryl sold a lot of grains and oils. (By the way, I still like GS after LEH and MER taken down badly. Goldman Empire from now on???)

Then again, thanks for bad housing markets. My lumbers are down a lot now. It consolidated for a while and took a few more dives in the last few days. I'm trying to sell 1 Nov 210P for $500 ish for cost averaging. Today the price came to 213, but my puts didn't get filled. If futures get so low, there's not much extrinsic value or no volume at all. Besides, Lumber is pit-traded contract, so god knows what pit traders do to screw people like me. I'll leave the order as it is for now.

I'm also trying to sell 70 CL puts. This extreme down move will end soon. If I get one more day of sell-off, I'll get filled, and when it bounces, I'll buy back. Now the problem is if I get one more day of selling or not.

As a 20/20 hindsight, I did exit the soybean-meal spread trade way early. The spread is now around $24K when I exited it was around $27K. An extra $6K (I was holding 2 spreads).... Ok, I'll go to corner and stay there for 10 mins as a punishment.

What a surprise, the feds just announced to keep the rate steady. Remember early this year, when Bear Sterns failed, we saw emergency Sunday night cut, lots of billions of injection etc. Here's what I am thinking. Every 'normal' people I know we're in deep trouble. Yes, we still are and we will for a while, but I think the worst could be finally behind. (Remember, when everybody knows, markets will do the exact opposite? ) When the feds rescued bears and even rescued Fannie and Freddie, there clearly seemed to be more serious coming. And yesterday there it was. Normally, lowering rates mean more liquidity, so markets love them. But we're in a situation where lowering rates mean more trouble to come.

This morning, it looked like markets are going to die (ES at -25 pts-ish), but 45mins after the keeping the rate news, we're rallying +15 pts! I always think that someone somewhere knows about what's going on. Not necessary smart people but they somehow have information about what will happen and we're seeing exactly that.

In terms of technical perspective, ES has a long bottom-tail, which is one of powerful signs of exhaustion. When technical meets fundamental, we see a steady move to one side. In this case, to the upside.

Remember Goldman Sachs said oil will go to $200 by the end of summer? People got scared and putting lots of money onto oil funds or natural resources. Oil is currently around $90! GS said it's supply / demand. Emerging countries' demands are getting higher and higher. I said that was a complete BS. It was all speculations after all. You see all hedge funds are liquidating everything to get chase. I bet Lehman and Meryl sold a lot of grains and oils. (By the way, I still like GS after LEH and MER taken down badly. Goldman Empire from now on???)

Then again, thanks for bad housing markets. My lumbers are down a lot now. It consolidated for a while and took a few more dives in the last few days. I'm trying to sell 1 Nov 210P for $500 ish for cost averaging. Today the price came to 213, but my puts didn't get filled. If futures get so low, there's not much extrinsic value or no volume at all. Besides, Lumber is pit-traded contract, so god knows what pit traders do to screw people like me. I'll leave the order as it is for now.

I'm also trying to sell 70 CL puts. This extreme down move will end soon. If I get one more day of sell-off, I'll get filled, and when it bounces, I'll buy back. Now the problem is if I get one more day of selling or not.

As a 20/20 hindsight, I did exit the soybean-meal spread trade way early. The spread is now around $24K when I exited it was around $27K. An extra $6K (I was holding 2 spreads).... Ok, I'll go to corner and stay there for 10 mins as a punishment.

Thursday, September 4, 2008

Sold all

I sold all of my Long (stocks) positions. Stocks (or indexes) were in a range for a long time and they broke down (ES' 1260) with a really big volume. I can tell a lot of big money flowing into the short side and this indeed seems to be a new leg down to test and break the 52-week low.

I have an order in Natural gas, but I don't think I'm gonna get filled unless it comes close to 6.7-ish. LB is doing nothing as usual. I might have to sell Nov puts since time decay is significant on Oct contract.

I have an order in Natural gas, but I don't think I'm gonna get filled unless it comes close to 6.7-ish. LB is doing nothing as usual. I might have to sell Nov puts since time decay is significant on Oct contract.

Tuesday, September 2, 2008

Thursday, August 28, 2008

Today

What a surprise, today. Stocks gaped up and went on and on. I haven't checked yet, but I think the volume is probably not strong. Considering 3 day labor day weekend, many traders take advantage of this whole week. Usually, the summer slow trading is done by Labor day. This year's summer has been pretty volatile, but the last few weeks have been very slow and choppy just like any other summer trading. As a trader, I like to see some more volatility. Anyway, whenever volume doesn't confirm its move, the move is suspicious. I'm thinking today's rally is in the same manner.

I waited 4 hours to take one trade, but the setup was invalidated at the last minute. Bummer. All I need is 1 or 2 good setups per day. I'm very confident with things I've been doing on ES, but I need to be a bit more aggressive.

On to Natural Gas. Wow. It was +0.8 (or +10%) before the report, but after the report, wow, dropped to almost -0.8 (or -10%). In order for me to get involved with NG, it has to come down to low 7 level while it's still fluctuating around 8. I have to be very patient regardless. If we have a follow-thru to the downside a few more days, I should be able to sell 6.5 for $2K-ish as I said earlier.

I waited 4 hours to take one trade, but the setup was invalidated at the last minute. Bummer. All I need is 1 or 2 good setups per day. I'm very confident with things I've been doing on ES, but I need to be a bit more aggressive.

On to Natural Gas. Wow. It was +0.8 (or +10%) before the report, but after the report, wow, dropped to almost -0.8 (or -10%). In order for me to get involved with NG, it has to come down to low 7 level while it's still fluctuating around 8. I have to be very patient regardless. If we have a follow-thru to the downside a few more days, I should be able to sell 6.5 for $2K-ish as I said earlier.

Tuesday, August 26, 2008

Thursday, August 21, 2008

Long 4 ES at 1273

Result:

+20 ticks or +$250 (less commissions)

This is something I've been working on a sim for quite some time.

+20 ticks or +$250 (less commissions)

This is something I've been working on a sim for quite some time.

Outlook

Wow, things are a lot worse than I thought. I moved my 403b money from stocks back to money markets on Monday (8/18). As soon as I saw lower high with an important trendline broken, I quickly moved. I took a stop loss on GS (-$120 loss) on '5' lots. I'm still holding AAPL since I have some cushions to work on. Techs still look great but without overall markets' help, it'll be hard.

Oil, gold, euro, grains etc all started resuming its trend to upside. I should start looking at gold or gold related stocks pretty quickly. Financials are really bad and they are weighing markets down. FNM and FRE could be gov-owned very soon. LEH might go bankrupt. As soon as one or both happen, I'll look long again. Buy the rumor, sell the news, isn't it?

I talked about possible new long term trades. Today Natural Gas shot up from inventory report. Well, my order may not get filled at all!

I exited my soybeans short at 1184 and 1272. I'll look to short the beans again if the spread gets about $35000.

Oil, gold, euro, grains etc all started resuming its trend to upside. I should start looking at gold or gold related stocks pretty quickly. Financials are really bad and they are weighing markets down. FNM and FRE could be gov-owned very soon. LEH might go bankrupt. As soon as one or both happen, I'll look long again. Buy the rumor, sell the news, isn't it?

I talked about possible new long term trades. Today Natural Gas shot up from inventory report. Well, my order may not get filled at all!

I exited my soybeans short at 1184 and 1272. I'll look to short the beans again if the spread gets about $35000.

Wednesday, August 20, 2008

Natural Gas plan

The logic behind for this trade (or Lumber I'm currently in) is as follows:

'The price of Natural Gas (NG) will never go zero.'

In order to take advantage of this opportunity, I start buying it from certain price levels (depending on aggressiveness). The simplest way is to buy futures outright and cost-average as it moves down. This type of cost-averaging is different from 'scale-in' in day trading. Because you know it will eventually go up.

A smart or safer way to get involved with NG is to sell puts. Currently NG is traded at 8.2ish and 7 Oct Put goes around 0.150 (or $1500).

http://quotes.ino.com/chart/?s=NYMEX_ON.V08.7000P&v=d12&t=l

The 7 (if assigned) would be the first leg of NG as if you are long futures outright from 7. For futures, you have to wait until price comes down to 7 and buy it. For options, you do not have to. If you think you can bring enough premium, you can sell way before it gets to the 7.

So, say, you sold the 1 contract of Oct 7 put. Two cases can happen:

Case 1. NG did up/down moves but on the option exp day, it didn't close below 7. The option you sold expired worthless, meaning you get to keep the whole premium you wrote ($1500).

Case 2. NG's closed below 7 (say 6.8), meaning you'll get an assignment very next day. In other words, in your futures account, you'll see one NG long contract from 7 (7 put option is gone) as if your option is converted into futures contract. (Since you sold 1 option, you are assigned 1 futures.) Now that the current price of NG is 6.8, you'll also see you're -$2000.

Note that in either case, you get to keep the premium anyway, so your account's balance went +$1500 more than before you wrote (or sold) the option. This also means, instead of losing -$2000, you're only down -$500 (= -$2000+$1500). If you bought futures contract outright at 7, you're -$2000, but because of option's premium you're only -$500 at the end. This is exactly why you want to utilize options. The benefit of using options don't stop here. In the case 1, you got paid $1500 by trying to get in at 7 whereas if NG didn't come down to 7, you're sitting on your hands doing nothing.

Of course, there's a catch. What if while you're holding your put option, NG drops below 7 and quickly moved higher and keep rallying to 9? The max profit from selling 7 put option is $1500 whereas if you bought futures outright at 7, your profit is $20,000. The choice is entirely up to you. I like to play on a safe side and that why I like to sell options and keep the sure thing instead of being a hero.

There are a few choices you need to make. At what price are you going to start selling? How much options premium do you like to bring? At what level are you going to start cost-averaging? What's your exit level if assigned 1, 2, 3 etc? Are you okay with margin?

If you're aggressive you can start selling 7 or 7.5 option. But since I'm not, I'll try to sell 6.5 put with $2K premium. Note that 7 or 7.5 you can bring $3-4K premium. My cost average level would be every 1 basis point. I'll throw an order to sell 5.5 put for $2K ish if NG keeps dropping. 4.5 and 3.5 the same way. The realistic downside of NG is about 5, so I would likely get filled on 2-3 levels max. For two levels, I have to go thru 10K-ish and for three levels, the drawdown would be $30Kish.

On the upside, if I get assigned on 6.5, I'll sell 7 to 7.5 call option for $4-5K premium. If the call expires worthless, I'll roll over to the next month and sell another call for $4-5K premium with the distance being at least 0.5 to 1. If I get assigned on that call, it'll offset my long (from 6.5), so I'll be flat. If price is attractive enough, I'll sell another 6.5 put for $2K. I'll do this over and over again.

Last year, NG stays around this price for a long time, so it was very very profitable (not me, but the guy I learned the way how to trade this way. Let's say at least $50K). I'm looking for at least $20-30K with this opportunity. Why is this possible? That's because unlike Lumber, NG's contract is traded every month. Lumber contract is quarterly whereas NG is monthly.

What you need to implement this strategy is:

-Pit-traded futures account (so that you can write options)

-Enough account ($50K minimum)

-Patience to go through drawdowns

Tuesday, August 19, 2008

New trades (potential)

I'm looking at a few new trades now and they are all long-term position trades. The strategy I'll be using is similar to my lumber trade. Basically I sell put options, and either take profits or get assigned. If assigned, I sell lower strike puts (cost-average) or sell higher-strike calls (covered call). If I don't get assigned, I sell another put at either lower or same strike price on another month.

They will eventually go up although cycles can take years.

-Orange juice

-Cotton

-Natural Gas*

*Natural Gas could be a real money maker, but it's not for new traders or small account holders. NG's margin is about $13K per contract and it can be very volatile. One should easily be able to handle $10-30K draw-downs. Rewards are very high regardless. Sell at the or slightly out-of money options could bring easily $2-4K in options premium and sell covered calls could bring $3-7K. What's good about the covered call is if the call is not assigned, your average price gets lower. If the call is assigned you would make $5-7K profits from the long position plus $3-7K options premium you wrote. If its price hangs around that level long enough with a good volatility, $20K profits are not unusual.

If none of this makes sense, I wouldn't consider selling options.

They will eventually go up although cycles can take years.

-Orange juice

-Cotton

-Natural Gas*

*Natural Gas could be a real money maker, but it's not for new traders or small account holders. NG's margin is about $13K per contract and it can be very volatile. One should easily be able to handle $10-30K draw-downs. Rewards are very high regardless. Sell at the or slightly out-of money options could bring easily $2-4K in options premium and sell covered calls could bring $3-7K. What's good about the covered call is if the call is not assigned, your average price gets lower. If the call is assigned you would make $5-7K profits from the long position plus $3-7K options premium you wrote. If its price hangs around that level long enough with a good volatility, $20K profits are not unusual.

If none of this makes sense, I wouldn't consider selling options.

Friday, August 15, 2008

Trading psychology (revenge mode?)

I'm still working on my psychology part of trading. Yesterday, I exited my 8-month long bean-meal spread. I didn't make as much money as I would hoped for, but made some. Great. Today I got up and checked the bean-meal spread as it became my habit for the past 8 months. Guess what, after I exited, it went in my favor of $1K, but more to come.

I don't know if this is normal, but I must have a bad ego. Since I exited, I want to prove that I made a good decision, but apparently it's not!

One of critical skills to learn in trading is the ability to quickly move onto a next trade. I don't think I'm quite there yet.

I don't know if this is normal, but I must have a bad ego. Since I exited, I want to prove that I made a good decision, but apparently it's not!

One of critical skills to learn in trading is the ability to quickly move onto a next trade. I don't think I'm quite there yet.

Thursday, August 14, 2008

Profit / Loss update

I updated my 2008 Profit / Loss. I decided to put the P/L based on liquidating value, which is more accurate instead of close-based value.

I'm up as much as the last year, but not by much. I must admit that it was more stressful this year because of the bean-meal position trades. Now that I exited that position, markets will go my direction. Isn't it what markets do any way?

The good news is I've been doing very well practicing a new strategy. My goal is to quit my day-job, by early January.

I'm up as much as the last year, but not by much. I must admit that it was more stressful this year because of the bean-meal position trades. Now that I exited that position, markets will go my direction. Isn't it what markets do any way?

The good news is I've been doing very well practicing a new strategy. My goal is to quit my day-job, by early January.

Soybeans - Soybean meal Spread summary

Soybeans/Soybean meal spread

Short 1 Mar Soybeans at 1236.25

Long 1 Mar Soybean Meal at 343.9

(entered on 1/2/08 )

-----------------

Covered 1 March S at 1391.50

Sold 1 March SM at 360.2Sold May S at 1409.4

Bought May SM at 367.5(Rolled over to May on 2/20/08)

---------------------

Short 1 May S at 1345 and Long 1 May SM at 353.7

(entered on 3/25/08)

-----------------

Sold 2 May SM at 343.10

Covered 2 May S at 1353

Long 2 Jul SM at 348.40

Short 2 Jul S at 1368.25

(Rolled over to Jul on 4/18/08)

------------------

Covered: 2 July Soybeans at avg of 1582.575

Sold back: 2 July Soymeals at 423.40

Short 2 Aug Soybeans at 1580

Long 2 Aug Soymeals at 421.2

(Rolled over to Aug on 6/27/08)

--------------------

Covered: 2 Aug Soybeans at avg of 1604.50

Sold: 2 Aug Soymeals at 428

Short 2 Nov Soybeans at 1580Long 2 Dec Soymeals at 411.4

(Rolled over on 7/1/08)

---------------------

Exited 1 spread;

Bought 1 Nov soybeans at 1180.5

Sold 1 Dec soybean meal at 313.30

(8/8/08)

-------------------

Exited 1 spread;

Sold SM at 349

Bought S at 1272.5

(8/14/2008)

Short 1 Mar Soybeans at 1236.25

Long 1 Mar Soybean Meal at 343.9

(entered on 1/2/08 )

-----------------

Covered 1 March S at 1391.50

Sold 1 March SM at 360.2Sold May S at 1409.4

Bought May SM at 367.5(Rolled over to May on 2/20/08)

---------------------

Short 1 May S at 1345 and Long 1 May SM at 353.7

(entered on 3/25/08)

-----------------

Sold 2 May SM at 343.10

Covered 2 May S at 1353

Long 2 Jul SM at 348.40

Short 2 Jul S at 1368.25

(Rolled over to Jul on 4/18/08)

------------------

Covered: 2 July Soybeans at avg of 1582.575

Sold back: 2 July Soymeals at 423.40

Short 2 Aug Soybeans at 1580

Long 2 Aug Soymeals at 421.2

(Rolled over to Aug on 6/27/08)

--------------------

Covered: 2 Aug Soybeans at avg of 1604.50

Sold: 2 Aug Soymeals at 428

Short 2 Nov Soybeans at 1580Long 2 Dec Soymeals at 411.4

(Rolled over on 7/1/08)

---------------------

Exited 1 spread;

Bought 1 Nov soybeans at 1180.5

Sold 1 Dec soybean meal at 313.30

(8/8/08)

-------------------

Exited 1 spread;

Sold SM at 349

Bought S at 1272.5

(8/14/2008)

Exit the last bean-meal spread

So I exited the last bean-meal spread;

Sold SM at 349

Bought S at 1272.5

I think grains are bottomed out at least temporarly. I'll look to re-enter when the spread goes back up to $35K. I was able to pull out $4000 on this trade, but still considering all the agony I had in the last 8 months, I don't know if this is worth or not.

Sold SM at 349

Bought S at 1272.5

I think grains are bottomed out at least temporarly. I'll look to re-enter when the spread goes back up to $35K. I was able to pull out $4000 on this trade, but still considering all the agony I had in the last 8 months, I don't know if this is worth or not.

Monday, August 11, 2008

Exit 1 bean-meal spread

So I exited one bean-meal spread (still holding one).

Bought 1 Nov soybeans at 1180.5

Sold 1 Dec soybean meal at 313.30

I made about $3K on this trade, but I really hope the 2nd leg would meet my objective, which should give me $10K or so. It's a shame that I couldn't hold on to a bit longer for what I just exited, but I went thru quite a bit of drawdowns and I do a lot better when I book some profits.

As you see the screenshot above, the spread trading is where you buy and sell two different contract simultaneously and expect the difference becomes bigger and smaller. I am losing (the shot was taken before I booked my profit), $19K on the soymeal, but making $39.6K on the beans.

By the way, lumber is not doing anything. It may take a while.

I'm also watching natural gas to see if it drops to 7 area where I'll start selling 6 puts.

Friday, August 8, 2008

Psychology

The number one reason that 90% of traders fail is due to psychology. I've been trading for a while, but I'm still struggling with it every single day.

The biggest one I have is the soybeans-meal spread. I was going thru a significant drawdown and now it came back up. As a matter of fact, I'm making some money, more than my monthly pay-check from a computer engineer job, but the problem it's still far less than the amount I risked. We all have invested or traded in one form or another and said to ourselves, 'if this thing comes back to break-even, I'll just get out and I'll never invest/trade.' That's the exact situation I'm in.

If I get out now, the reward-risk ratio would be 1:7. (Risking $7 to make $1, which is not right!) In order to survive in trading, I need at least 1:1 ratio. But man, my target is still so far a way. I don't know if I can fight for it or not.

The biggest one I have is the soybeans-meal spread. I was going thru a significant drawdown and now it came back up. As a matter of fact, I'm making some money, more than my monthly pay-check from a computer engineer job, but the problem it's still far less than the amount I risked. We all have invested or traded in one form or another and said to ourselves, 'if this thing comes back to break-even, I'll just get out and I'll never invest/trade.' That's the exact situation I'm in.

If I get out now, the reward-risk ratio would be 1:7. (Risking $7 to make $1, which is not right!) In order to survive in trading, I need at least 1:1 ratio. But man, my target is still so far a way. I don't know if I can fight for it or not.

Tuesday, August 5, 2008

FOMC

So the feds held the key rate at 2% (I believe). The decision was a piece of cake because as many of you know the price of commodities easied quite a bit. For example oil was at 145 not too long ago, and today we dipped below 120. That's about 15% drop. Not to mention, gold, euro and grains, they all fell nicely. The feds had to dilemas: inflation and liquidity (jobs, money from gov to banks, etc). Since the inflation has been easied and the credit crisis is slowly recovering, there's no reason for the feds to raise.

People were heavily investing money on inflationary instruments and they've been pulling out quite a bit. Where is that money? As I said in the previous post, stocks suddenly became very attractive.

Either the worst is behind or not, markets are liking what the feds are doing. Once dollar starts breaking high out of the consolidation, we'll see more drop in commodities. This doesn't mean, of course, oil drops to $50 and stays there, but we'll not see a parabolic type up-move near soon.

I have moved all of my 403b plan back to stocks and global equities and purchased some stocks in Roth IRA a few days ago. I maybe wrong, but I think we have a good shot here.

People were heavily investing money on inflationary instruments and they've been pulling out quite a bit. Where is that money? As I said in the previous post, stocks suddenly became very attractive.

Either the worst is behind or not, markets are liking what the feds are doing. Once dollar starts breaking high out of the consolidation, we'll see more drop in commodities. This doesn't mean, of course, oil drops to $50 and stays there, but we'll not see a parabolic type up-move near soon.

I have moved all of my 403b plan back to stocks and global equities and purchased some stocks in Roth IRA a few days ago. I maybe wrong, but I think we have a good shot here.

Tuesday, July 22, 2008

Outlook

We're living in a very interesting time for sure. Oil doubled its price in a matter of few months, grains tripled with in a year, dollar has been continuously getting devalued, gold hanging just under all time time etc...

As many of you know, we're facing two big problems. Inflation and recession. Inflation is from of course high food and energy and the main problem of recession is caused by sub-prime mess. Feds kept lowering rates for market liquidity, which eventually made inflation worse. When Fannie and Freddie were about to go bankrupt, people thought the worst was not yet over.

Feds, however, are dying to raise the key rate to ease inflation and I think that's about to happen soon. In Europe, there's no credit crisis. Their #1 priority is inflation, why they just started their rate, which gives a lot of pressure in dollar, so we do not have much choice. But it can't be done without solving our banking issue.

This week 5 big banks came with a lot better than expectation. I think this might be the bottom of the financial crisis. Smart money was in inflationary instrument (is that a right way to say?) and now it's moving back to equities.

Oil is coming down really hard. Goldman Scachs' outlook on oil is about $200 whereas Lehman's expecting $80 per barrel by end of 2008. Can you believe that two main hedge firms' outlooks are completely opposite. $200 in crude is about $6 / gallon in gas pump.

I'm leaning towards to $80 because I started seeing things that I've never seen around people. Our solutions about high oil were to dig more oil and support oil companies so that they can find better ways to get more oil. What did gov's subsidy do on enthanol and bio-diesl plan? It made things worse not only in oil but also in grains (food). We wanted others to solve problems for us instead of us being proactively find a way.

People are finally talking about changing behaviors. People are looking for 'compact' cars, electric vehicles, less travel etc. The #1 rule I learned from markets is when everybody knows markets do the exact opposite. Everybody things demands in India and China will exceed the supply. I disagree. A lot of it has to do with speculations and the sharp dropping in oil is exactly the proof of that in my opinion.

My money in retirement account has been sitting in money market since Dec 2007. My money was at global and domestic equities, but after I saw the credit problem, I got it out pretty quickly. Sure I didn't exit at the top, but I got out well above where we are now. I look at the funds I was in, it's -15% year to day. I'll look to move my money back there.

As many of you know, we're facing two big problems. Inflation and recession. Inflation is from of course high food and energy and the main problem of recession is caused by sub-prime mess. Feds kept lowering rates for market liquidity, which eventually made inflation worse. When Fannie and Freddie were about to go bankrupt, people thought the worst was not yet over.

Feds, however, are dying to raise the key rate to ease inflation and I think that's about to happen soon. In Europe, there's no credit crisis. Their #1 priority is inflation, why they just started their rate, which gives a lot of pressure in dollar, so we do not have much choice. But it can't be done without solving our banking issue.

This week 5 big banks came with a lot better than expectation. I think this might be the bottom of the financial crisis. Smart money was in inflationary instrument (is that a right way to say?) and now it's moving back to equities.

Oil is coming down really hard. Goldman Scachs' outlook on oil is about $200 whereas Lehman's expecting $80 per barrel by end of 2008. Can you believe that two main hedge firms' outlooks are completely opposite. $200 in crude is about $6 / gallon in gas pump.

I'm leaning towards to $80 because I started seeing things that I've never seen around people. Our solutions about high oil were to dig more oil and support oil companies so that they can find better ways to get more oil. What did gov's subsidy do on enthanol and bio-diesl plan? It made things worse not only in oil but also in grains (food). We wanted others to solve problems for us instead of us being proactively find a way.

People are finally talking about changing behaviors. People are looking for 'compact' cars, electric vehicles, less travel etc. The #1 rule I learned from markets is when everybody knows markets do the exact opposite. Everybody things demands in India and China will exceed the supply. I disagree. A lot of it has to do with speculations and the sharp dropping in oil is exactly the proof of that in my opinion.

My money in retirement account has been sitting in money market since Dec 2007. My money was at global and domestic equities, but after I saw the credit problem, I got it out pretty quickly. Sure I didn't exit at the top, but I got out well above where we are now. I look at the funds I was in, it's -15% year to day. I'll look to move my money back there.

Still holding

Not much going on. I'm still holding 2 soybean-meal spread and 2 lumber trades. The spread trade came back to my way, but still far from my targets. I'm just getting really impatient though because when it came back last time and gave me about $5K profits, I didn't take it and it then moved against me quite a bit. I feel as if I just need to get out at break-even. However, that's not what's about trading. I just risked huge amount of money, and get out at b/e???

Lumber is giving me more pressure than before. It looked like it was bottoming out and then it broke the support making a new low. Everybody knows about how bad these housing markets are. I threw an order to sell 1 Sept 230 puts. Lumber has never been to this low and all I can say is it's 'well' below its cost of production. Supply and demand will eventually kick in, but it takes a while for sure.

Lumber is giving me more pressure than before. It looked like it was bottoming out and then it broke the support making a new low. Everybody knows about how bad these housing markets are. I threw an order to sell 1 Sept 230 puts. Lumber has never been to this low and all I can say is it's 'well' below its cost of production. Supply and demand will eventually kick in, but it takes a while for sure.

Thursday, July 3, 2008

Buy 4 ES at 1262.25

Results:

-1.5 pt or -$300 (minus commissions)

I did like the setup, but oh well. I'll take this kind of trade every day tho.

-1.5 pt or -$300 (minus commissions)

I did like the setup, but oh well. I'll take this kind of trade every day tho.

Friday, June 27, 2008

Roll-over

I rolled over my soybean-meal spread trade from July to Aug. I guess I should have rolled over to Nov where there are tons of volume. I suppose a beginner's mistake.

Covered: 2 July Soybeans at avg of 1582.575

Bought back: 2 July Soymeals at 423.40

Short 2 Aug Soybeans at 1580

Long 2 Aug Soymeals at 421.2

I've been holding this position for 6 months now. I almost forgot to roll-over which would have resulted in a stack of soybeans in front of my house.

Covered: 2 July Soybeans at avg of 1582.575

Bought back: 2 July Soymeals at 423.40

Short 2 Aug Soybeans at 1580

Long 2 Aug Soymeals at 421.2

I've been holding this position for 6 months now. I almost forgot to roll-over which would have resulted in a stack of soybeans in front of my house.

Wednesday, June 18, 2008

6/17/08, Sold 4 ES at 1363.25

Results:

$150 minus commissions.

I forgot to record this yesterday, so I'm doing it now. If you can recall, I've been simulating a new strategy for about 2.5 months and I finally took my first live trade. Day-trading always makes me much much more nervous. However if I can achieve consistency in day trading, it's just matter of time till i double, tripple the size of contract.

$150 minus commissions.

I forgot to record this yesterday, so I'm doing it now. If you can recall, I've been simulating a new strategy for about 2.5 months and I finally took my first live trade. Day-trading always makes me much much more nervous. However if I can achieve consistency in day trading, it's just matter of time till i double, tripple the size of contract.

Update: GCL 150 Calls

July Crude 150 Calls expired worthless. So I collected all the premium of $550. What's good about selling options is if it expires worthless, I don't need to exit at all ending up saving commissions too.

The oppertunity was almost ridiculous and glad it worked ok. Sure it could have gone to 200, but with one week left, I thought I had a very good chance. One mistake I did was, had I waited right before the close, I could have sold the same options for $1500.

The oppertunity was almost ridiculous and glad it worked ok. Sure it could have gone to 200, but with one week left, I thought I had a very good chance. One mistake I did was, had I waited right before the close, I could have sold the same options for $1500.

Friday, June 6, 2008

Sold 1 July CL 150 calls

I sold it again for 0.55 (or $550). I didn't expect CL's +11 POINTS in a day. Now it's trading at 139 with the option value of about $1250 (or I'm losing -$700). With this pace, the CL can easily hit above 150 in a day or two. It expires in 10 days and the volatility is ridiculous. This is an absolute panic buying. I do not plan to exit the position. Either it gets expired worthless, or I get assigned.

If I do get assigned, I'll hold on to the short position for a possible profit of $500. If it does expire worthless, I'll make $550. Time is in my favor in this option or any option selling position. Each day it should lose its value about $100/day should CL doesn't move. If it drops, the time decay accelerates, then I'll consider an early exit.

If I do get assigned, I'll hold on to the short position for a possible profit of $500. If it does expire worthless, I'll make $550. Time is in my favor in this option or any option selling position. Each day it should lose its value about $100/day should CL doesn't move. If it drops, the time decay accelerates, then I'll consider an early exit.

Wednesday, June 4, 2008

Covered CL 150 calls for 0.06

I exited CL call for $490 profit (less commissions). The opportunity was awesome, but took advantage of panic in options market. It worked out nicely.

Tuesday, May 27, 2008

Update

Not much going on here. I'm still holding the bean-meal spread, lumber and crude call. Crude took a big dip today which brought the premium from $720 to $240. My exit is at $100, so another $140 to go, which will give me $450 profit. This is why you want to sell options. All you need is a one big down day and you will see all the time decay it's got and options will get deflated.

On the other hand, I was ready to add one more leg on the bean-meal spread, but right before I got it, it turned around started heading down, so I guess I will wait. If it goes up, I'll add, if it keeps going down, I'm profiting from my current position anyway.

Lumber is not doing anything. I'm waiting until the 2nd part of this year to start kicking. If it starts move, I'm seeing at least $15000 profit. I would like to see profits, but I must be patient.

On the other hand, I was ready to add one more leg on the bean-meal spread, but right before I got it, it turned around started heading down, so I guess I will wait. If it goes up, I'll add, if it keeps going down, I'm profiting from my current position anyway.

Lumber is not doing anything. I'm waiting until the 2nd part of this year to start kicking. If it starts move, I'm seeing at least $15000 profit. I would like to see profits, but I must be patient.

Tuesday, May 6, 2008

Sold 1 CL 150 Calls for 0.55

I sold this morning 1 July CL 150 calls for 0.55 or $550. CL oil has a ridiculous opportunity here. almost about 30 points away with a little over a month left. We'll see how this plays out.

Thursday, May 1, 2008

Roll over in Lumber

I rolled over 2 lumber positions.

Sold 2 May Lumber at 212.20

Bought 2 July Lumber at 239.90

Sold 2 May Lumber at 212.20

Bought 2 July Lumber at 239.90

Wednesday, April 30, 2008

Still testing and watching

It's been a while since my last post. I'm very dilligently testing my new ES strategies. I'm getting there, but not yet ready to risk my real money. In the mean time, I was able to get $3.3RT for ES where I can use Zen-fire, institutional service, that provides unfiltered data and that account is fully funded. I also wrote a program in Visual Basic (I never wrote a program using VB before. I was a hard core Java guy) that utilize my money management. I even built a live dome!

As far as my position trades go, they are just hanging there. It seems that I'm not going to exit my spread until soybeans drop to $11/b level. Once I exit this position, I have to be more selective on position trades. Lumbers are all time low, but with housing markets, it'll take a while.

Hope everybody is doing great and let's see what FOMC brings today. Some say we're nowhere done from credit crisis and some think the worst is behind. I personally think either we are used to this situation already or we're getting better. Remember, stock markets are the most efficient instrument to gage our economy. If we get acceptance above 1400, I would say we go higher.

As far as my position trades go, they are just hanging there. It seems that I'm not going to exit my spread until soybeans drop to $11/b level. Once I exit this position, I have to be more selective on position trades. Lumbers are all time low, but with housing markets, it'll take a while.

Hope everybody is doing great and let's see what FOMC brings today. Some say we're nowhere done from credit crisis and some think the worst is behind. I personally think either we are used to this situation already or we're getting better. Remember, stock markets are the most efficient instrument to gage our economy. If we get acceptance above 1400, I would say we go higher.

Monday, April 21, 2008

Update

Nothing new here. Still holding the spread and the lumber trade. I'm not used to this kind of super-long-term trade, so I have to be very patient.

I'm giving one more week of new scalping setups. I will go live if I become consistent in this final week. I'll start 4 lots.

I'm giving one more week of new scalping setups. I will go live if I become consistent in this final week. I'll start 4 lots.

Friday, April 18, 2008

Roll over

I rolled over my spread trade to July.

Sold 2 May SM at 343.10

Covered 2 May S at 1353

Long 2 Jul SM at 348.40

Short 2 Jul S at 1368.25

Sold 2 May SM at 343.10

Covered 2 May S at 1353

Long 2 Jul SM at 348.40

Short 2 Jul S at 1368.25

Tuesday, April 8, 2008

Position update

It's been a while since my last update. The main reason for that is I really need to manage my swing position. The spread went in my favor after planting report, but I thought it had more room to go, but it completely turned around and now I'm sitting about at break-even. This could take months to work out, but I hate seeing the spread goes to $40K again. Now I have two lots, I have to deposit more. However I still like this trade. I'm looking at least $10K profit off of this trade.

Lumber started showing some signs. Yeah, I know about housing markets, but we all know that when 'everybody' talks about something, it's time to do the exact opposite. I'm well positioned on Lumber. If May contract goes about 250, I'll sell 270 Call so that if the market drop back, I'll take the premium lowering my b/e level.

I'm also working on a new strategy in ES. So far very consistent, but need to simulate more. Previously, I hurried on trading from sim, I ended up losing a lot. I do not want to do that for sure this time. I'll most likely start with $10K trading 4 lots of ES. When I started doing that, I'll post live updates here.

As far as the money club I'm in, it is profitable, but slightly above +1% since inception. I will take everything out in July which will give lots of flexibility on my other trading account. If things go well, I should be trading 20 lots on ES (Yes, I'm very confident).

At the moment, I'm also programming to accommodate advanced order entry. I could buy a software and pay $4.10 RT on ES, but if I don't use that software and program it myself, I can get $3.30RT. If I trade more later, that 80 cents different will add quickly.

Lumber started showing some signs. Yeah, I know about housing markets, but we all know that when 'everybody' talks about something, it's time to do the exact opposite. I'm well positioned on Lumber. If May contract goes about 250, I'll sell 270 Call so that if the market drop back, I'll take the premium lowering my b/e level.

I'm also working on a new strategy in ES. So far very consistent, but need to simulate more. Previously, I hurried on trading from sim, I ended up losing a lot. I do not want to do that for sure this time. I'll most likely start with $10K trading 4 lots of ES. When I started doing that, I'll post live updates here.

As far as the money club I'm in, it is profitable, but slightly above +1% since inception. I will take everything out in July which will give lots of flexibility on my other trading account. If things go well, I should be trading 20 lots on ES (Yes, I'm very confident).

At the moment, I'm also programming to accommodate advanced order entry. I could buy a software and pay $4.10 RT on ES, but if I don't use that software and program it myself, I can get $3.30RT. If I trade more later, that 80 cents different will add quickly.

Monday, March 31, 2008

Update

1. Beans - Meal spread.

I first got involved with the spread when it was around $27K. The spread is usually around $15K, so I thought I was in a very good position expecting minimum or almost no drawdown. This spread went as high as about $40K, which means my drawdown was about -$13K! What kind of system is that allowing a drawdown of -$13K, but I had to hold onto because it's a fact based trade. I know eventually the spread will get smaller. If I had money to add on, I would have definitely, but I couldn't in case it would go worse.

Gladly, now it's back about $27K. I added one more leg on it way move down around $31K, which gave the avg cost of $29K. So where is my target? I will take one leg off at $22K level and hold on to the last piece until $18K.