I bought AAPL at 93.5 a few days ago and today I sold half of my position at 107.5. I traded off of Roth IRA, so even if it's about 14 pts, I didn't have many shares. Going into FOMC announcement, I thought I should sell and buy back if we get a pull back. Granted, if we can consolidate at this level for a week, we might see some up move.

Yesterday's action was really good for bulls. Engulfing pattern is one of powerful reversal patterns I've seen. But remember the trend is still down.

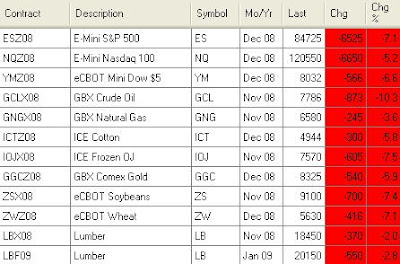

Other commodities are all rallying today. If or when we get out of this mess, I can see people complain again about inflation. At that time, oil should go to 200 and beans go to $20/b easily.As with other futures, natural gas completely moved away. This time, I really want to be prepared for that situation.

As for NG trade, I just don't have much luck with it or I'm just too conservative as it came close to my entry but moved away significantly.

Wednesday, October 29, 2008

Tuesday, October 21, 2008

Losing patience

I'm really losing my patience here. I still do think we're going to go down futher to 'really' scare people away.

I bought '25' shares of AAPL on my Roth IRA (4K account!). AAPL's earning is today. I do like the company and I mean I really like the 'value' of the company.I own a few apple products and they are great. I'll like to hold these for a while regardless of the earning's result. Besides, I just ordered a new aluminum macbook and I'm very excited. My wife will take over my old white macbook. :) (thanks, hon.)

Lumber is where I really lose my patience at. Another limit down today. Markets go through inflation and deflation, but what's funny about lumber is, it has been deflated for about 2 years and still deflating. I'm wondering if it can actually go to zero. Will lumber be free? At least, since I'll build a house in 4 months, hopefully I can benefit the low lumber price.

Did I tell you have a Realtor license? I just got it to know about home buying and selling. Guess what, it seems I'll be a licensed general contractor as well. Maybe I'm too cheap, but I don't think they should be paid for work they 'usually' do at least in my area. The realtor exam was not hard and it doesn't seem on the general contractor either (1 book, 4 hr long open book test).

Typically, if you become your own general contractor, you can save 'at least' 20% of builders' quote. If you build your own house, you don't have to be licensed, but the community I'm looking at requires to hire a licensed one. Besides, lenders don't really like doing construction loan unless I deal with a licensed one. Above all, I really like to know what's involved and I want to build it right!

I don't usually talk about other stuff than markets, but I just suddenly thought about it. Sorry, if you're not interested.

OK, looks like AAPL's earnings came out. I bought mine at 93.50 and it had a little pop, but came back to my entry although it was down quite a bit before the announcement.

I bought '25' shares of AAPL on my Roth IRA (4K account!). AAPL's earning is today. I do like the company and I mean I really like the 'value' of the company.I own a few apple products and they are great. I'll like to hold these for a while regardless of the earning's result. Besides, I just ordered a new aluminum macbook and I'm very excited. My wife will take over my old white macbook. :) (thanks, hon.)

Lumber is where I really lose my patience at. Another limit down today. Markets go through inflation and deflation, but what's funny about lumber is, it has been deflated for about 2 years and still deflating. I'm wondering if it can actually go to zero. Will lumber be free? At least, since I'll build a house in 4 months, hopefully I can benefit the low lumber price.

Did I tell you have a Realtor license? I just got it to know about home buying and selling. Guess what, it seems I'll be a licensed general contractor as well. Maybe I'm too cheap, but I don't think they should be paid for work they 'usually' do at least in my area. The realtor exam was not hard and it doesn't seem on the general contractor either (1 book, 4 hr long open book test).

Typically, if you become your own general contractor, you can save 'at least' 20% of builders' quote. If you build your own house, you don't have to be licensed, but the community I'm looking at requires to hire a licensed one. Besides, lenders don't really like doing construction loan unless I deal with a licensed one. Above all, I really like to know what's involved and I want to build it right!

I don't usually talk about other stuff than markets, but I just suddenly thought about it. Sorry, if you're not interested.

OK, looks like AAPL's earnings came out. I bought mine at 93.50 and it had a little pop, but came back to my entry although it was down quite a bit before the announcement.

Monday, October 13, 2008

Short covering

What a day. Cash nasdaq +168, dow +813 and s&p +92 right now. We were over-due for a bounce, but jeez.

As we're still in a down-trend, I don't think the worst is over yet. I want markets to go up and up so that econ is going and I can get out of my lumber trade, but you don't see many 'V' bottoms. Bottoms are usually rounded and happen after a long range-consolidation whereas tops usually have inverted V shape.

Think of this way. We went straight down for a few days in a row without any pullback. It was absolute panic selling. Pros, who still have a lot of money, are thinking if you missed the boat to short, what's the logical place to short. Pros seem to wait for pullback (especially in indexes).

I don't know if we'll make a new low or not, but I think we'll have another downside to make either a new low, or a higher low. What traders should look for is the move between a well established resistance to the Friday's low. 1060 level in ES seems like a good level to go short, should we get there.

Keep in mind that it's an options expiration week (10/17). People probably loaded with puts and scared money is in the puts side. Markets will try to make them as worthless as possible. This might conincide with a rally to 1060 level, so let's see.

Friday, October 10, 2008

Everybody is selling everything

I don't know if you can see it, but basically every futures contract I'm watching is selling off not to mention Crude oil is -8.73 or -10% and lumber -3.7 or -2%. You know what indexes are doing of course.

In current market environment, everybody wants cash. People get margin calls and need to liquidate their positions. I even see margin on ES or lumber increased quite a bit, so I had to deposit some more.

I'm looking to sell Nat gas and have orders in. This will be another long term trade, but unlike Lumber, NG is very volatile and I should be able to be in and out of options all the time.

I looked at the performance of the money club I was in. At the beginning of Aug it had about 4 million and guess how much it has now. 2.4 million. I'm losing money on that, but gladly I took 93% of my money before I got hit.

Preserving your cash is not a bad idea. Today's close could be very important. I'm expecting we rally up and have a strong close to force some short covering. But what I do know. I'm still trying to learn how to trade.

Tuesday, October 7, 2008

Wacky idea

Here's an extreme (but unrealistic) idea.

In the last few days, nasdaq went down -75 pts every day (roughly), s&p went down -40 pts and -400 pts on dow. Today I thought what if indexes keep dropping. For example, S&P is currently traded around 1000. With this pace, it takes only 25 days for S&P to go to zero from 1000. Have you ever thought that indexs go zero???

I know it's not possible because stocks get kicked out of s&p if they are not doing well. Many people got involved with stocks lately because they are cheap. I'm trying to tell them over and over again that stocks can go zero, but no one listens and keep buying LEH, FNM, FRE etc...

In the last few days, nasdaq went down -75 pts every day (roughly), s&p went down -40 pts and -400 pts on dow. Today I thought what if indexes keep dropping. For example, S&P is currently traded around 1000. With this pace, it takes only 25 days for S&P to go to zero from 1000. Have you ever thought that indexs go zero???

I know it's not possible because stocks get kicked out of s&p if they are not doing well. Many people got involved with stocks lately because they are cheap. I'm trying to tell them over and over again that stocks can go zero, but no one listens and keep buying LEH, FNM, FRE etc...

Monday, October 6, 2008

Opportunities

Everybody is in fear. People at work who usually talk about sports or politics are talking about stock markets. I'm in the same fear as well. I was going to start building a house in 2 months, but I told my wife that we better wait until Jan 09 or so.

My supervisor who's about 45 years old said he's -30% YTD in his retirement account. I would safely say that's about -$100K. At work, I don't talk about markets much because people don't understand what I do (as a side job?) anyway. I didn't even tell all of my retirement money is on cash since Dec 07.

As global markets go down including indexes and other leverage instrument, there are a few markets that started looking very attractive. I talked about this before, but they quickly bounced off and ran away. Now it's back. Sure, the lumber trading still gives me a lot of headache (today limit down, ouch), but I need to be objective.

1. Cotton. Look at monthly chart to see where we're. I'm thinking about selling 50 puts and slowly accumulate.

2. Orange juice. This is at an interesting level, but I think it needs to come down more just to be conservative.

3. Natural gas. I'll be very aggressively positioned. The current price of NG is 6.8ish. I'll sell 6 puts for $1500 or better. Then every 0.5, I'll sell more put for another $1500+. I have a good chunk of money sitting at the bank (which I was going to use to build a house) and I just requested a transfer and I'll send a check to my broker this week. I know this doesn't happen often, so I want to make sure I'm involved with it.

The point is when the public is in panic, there's always something one can take advantage of.

Just be careful in this market and make sure you do not overtrade.

My supervisor who's about 45 years old said he's -30% YTD in his retirement account. I would safely say that's about -$100K. At work, I don't talk about markets much because people don't understand what I do (as a side job?) anyway. I didn't even tell all of my retirement money is on cash since Dec 07.

As global markets go down including indexes and other leverage instrument, there are a few markets that started looking very attractive. I talked about this before, but they quickly bounced off and ran away. Now it's back. Sure, the lumber trading still gives me a lot of headache (today limit down, ouch), but I need to be objective.

1. Cotton. Look at monthly chart to see where we're. I'm thinking about selling 50 puts and slowly accumulate.

2. Orange juice. This is at an interesting level, but I think it needs to come down more just to be conservative.

3. Natural gas. I'll be very aggressively positioned. The current price of NG is 6.8ish. I'll sell 6 puts for $1500 or better. Then every 0.5, I'll sell more put for another $1500+. I have a good chunk of money sitting at the bank (which I was going to use to build a house) and I just requested a transfer and I'll send a check to my broker this week. I know this doesn't happen often, so I want to make sure I'm involved with it.

The point is when the public is in panic, there's always something one can take advantage of.

Just be careful in this market and make sure you do not overtrade.

Saturday, October 4, 2008

Bloody September

I thought I was well diversified and I thought I was safe from the whole credit problem. My retirement has been staying out of stocks since Dec with +11% profit. I took 95% of my money out of my club (options) with +12% profit. They all are going through huge drawdowns and I protected my money well.

The big problem came from the Lumber. It's like a free fall and I'm getting killed. Lumber is well below the cost of production, but still falling. What's funny is I went to local lumber store to get some recommendation about framing companies. The store's manager said lumber price has stayed the same for the whole year? I was thinking, Whah? The futures went from 300 to 200 or -33%, but the lumber material is the same? Furthermore, he said the price of shingles are up because of the oil. Oil was at 150, but now below 100 and that should be -33% or so, but it stayed the same? Who takes all the money then?

Last month, I had about $8-9K profit, and I lost all in Sept. I'm still +$4K for the year, but was up almost $20K at one point. Of course, there are tons of mutual funds that were shut down or going through -25% YTD, so I'm guessing I'm okay, but it sure tastes sour.

Subscribe to:

Posts (Atom)